- Focused on delivering its 3:3:3 promise; number of customers increased 20% to 1.8 million in 3Q22

- Continue to make very good progress vs. our 8 commitments for 2023 – focus remains on 2021-2023 plan achievement

- 3Q22 NWP and NEP on upward trend at 68.5% and 64.3% growth YoY

- Robust topline underpinned by strong retention ratios across all LOB

- NWP growth observed across all preferred pillars – Lifestyle, Health and SME

- Investment losses narrowed but weighed by volatile equity and bond markets

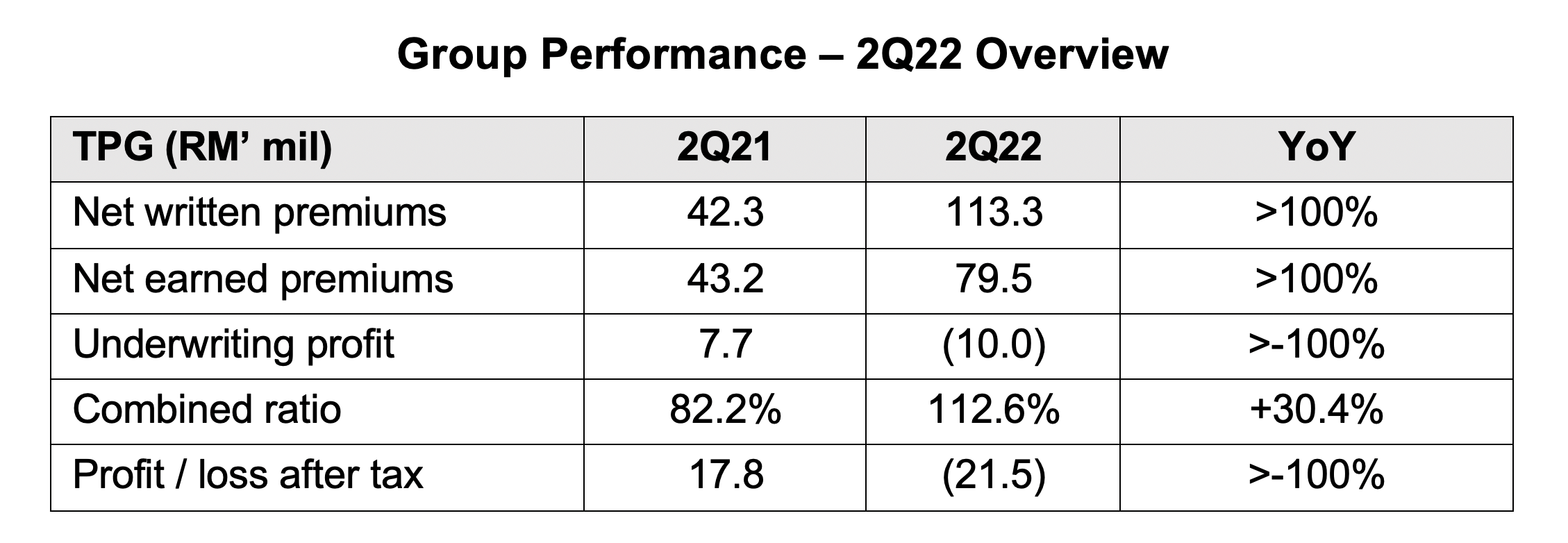

The Group however, recorded a loss after tax (“LAT”) of RM12.2 million as the high topline growth requires time to be realised as earned premiums in addition to normalisation of Motor claims post lockdown and investment losses. This was an improvement over 2Q22, and the Group expects this to continue to improve over the next quarters.

Rising customer count Tune Protect’s number of unique active customers has risen from 1.5 million in 1Q22 to 1.8 million in this quarter, a 20% increase over the year. The number of digital policies has also increased by 19% from 6.33 million in 9M21 to 7.53 million in 9M22. “We’ve launched a regional brand campaign in September 2022 with a focus on driving engagement on our mobile app with the ‘Click to Start’ campaign. Coupled with the aggressive e-Commerce and digital marketing campaigns, we are seeing favourable results in the number of customers and policies,” Rohit said. Tune Protect is committed to servicing its retail and individual customers with its 3:3:3 commitment where they can purchase insurance in just 3 minutes, receive a response in 3 hours and receive their claims payout in just 3 days1.

Topline growth outpaced expenses Rohit Nambiar (“Rohit”), Tune Protect Group’s Chief Executive Officer said that the Group’s 3Q22 results show that the organisation’s growth plans are on the right track.

“The Group managed to register robust 3Q22 topline growth which continued to outpace expenses. In addition, the company achieved a commendable retention ratio of close to 70% in all of our preferred LOB. There were higher commissions attributable to the increased topline, as well as rising operating expenditure (“Opex”) due to staff cost in developing talent and marketing cost in line with business recovery. Although investment losses narrowed during the quarter over the year, investments were still adversely affected by weak market conditions for bond funds, as well as equity.” “As an Insurtech, this is a vital KPI for us as it shows we are both expanding aggressively, but also investing in our tech and people’s capabilities,” Rohit said.

Improved ratios and normalising claims Rohit stated that the Group has persevered in its efforts to improve organisational efficiencies, especially on a ratio basis. “Other healthy indicators for the Group during the quarter were the improved expense and retention ratios. This was however impacted by normalising claims on the Motor segment. There was also strong growth of consolidated NWP across 3 of our core Lifestyle, SME and Health pillars, although the Commercial pillar declined in line with our plan to reduce exposure in this segment,” Rohit explained.

The Group’s healthy retention ratio increased from 48% in 3Q21 to 69% in 3Q22, which is very close to the Group’s target of 70%, attributable to solid YoY growth across all preferred LOB. The NWP improvement was led by the Health pillar driven by the Vietnam and foreign worker segments; the Lifestyle pillar was led by the personal accident (“PA”) segment; the Motor and Travel pillars were led by the Group’s digital partners; and the small and medium enterprise (“SME”) pillar was led by the Fire segment.

Fintech partnership in Vietnam The Group is also progressing with its expansion plan in Vietnam by announcing 2 new major partnerships in the country, including a giant digital payment gateway which is scheduled for launch by the end of 2022. The Group is partnering with one of the largest financial technology (“fintech”) companies in Vietnam with 15 million active individual users and more than 150,000 corporate clients. Continuing its stride in digital partnership, the Group has also secured Fly Arna, the Armenian low-cost airline as the 6th airline partner for its Travel business.

Our Tech business – White Label “We are also evolving our tech arm, White Label as a profit centre by continuously simplifying the company’s use of technology to offer our customers the best experience. This includes centralised records of customers, simplified and automated workflow processes, immediate policy processing, speed-to-market innovation as well as increased efficiency and data accuracy. Our mobile-first strategy continues to bear fruit with double-digit growth in digital partnerships and e-commerce in 3Q22. During the quarter, we went live with our core system phase 1 in Malaysia combined with cloud, making us the first insurer to put our core system on the cloud,” Rohit said.

Awards recognition Tune Protect has been recognised at the Insurance Asia Awards 2022, receiving 2 awards for the Insurance Administrator of the Year – Malaysia and the Travel Insurance Initiative of the Year – Malaysia. This is the third recognition for Tune Protect this year after the Employee Experience Awards 2022 Malaysia and its Thailand operations won the Global Banking & Finance Awards 2022.

Bonds to end year with positive returns However, the Group’s investment income in 3Q22 was weighed down by continued uncertainties in the Asia Pacific equity market, particularly in China. China’s Zero Covid Policy (“ZCS”) as well as the sustained record-high inflation in the US continues to be a drag on market returns. On the bright side, our conservative positioning in the domestic bond market has shielded us from much of the volatility arising from the relentless upward drive in the US Fed Fund Rates.

“We have made a conscious decision to cut our exposure in the equity market, while we are expecting our bonds to end the year with positive returns. Markets will continue to be volatile. The growing fears of recession led to a bond rally in July 2022, but it will take another quarter to confirm the direction of the US led global economy,” Rohit concluded.

1 Terms and conditions apply