KUALA LUMPUR, 21 October 2022 – Tune Protect Malaysia (“the Company”, “Tune Protect”), the General Insurance subsidiary of Tune Protect Group Berhad (“Group”) handed over Perlindungan Tenang PA Care insurance certificate to the orang asli of Kampung Sri Broga which consists of the Temuan tribe in Selangor recently.

The handover ceremony was offciated by Jubin Mehta, Chief Executive Officer Tune Protect Malaysia and Mohamad Anis bin Othman, Director of the Department of Orang Asli Development (JAKOA) Selangor, accompanied by Mohd Yusof Hafiz Mohamad, Chief of Governance Tune Protect Group Berhad.

With the Perlindungan Tenang voucher, a national initiative by the government of Malaysia, over 30,000 orang asli received Perlindungan Tenang PA Care from Tune Protect Malaysia, with the support of JAKOA.

All Posts in Category: Press Releases

TBWA\ Malaysia Appointed Agency Of Record For Digital First Insurer, Tune Protect

KUALA LUMPUR – OCTOBER 5, 2022

TBWA\Malaysia has been awarded the creative business portfolio for Tune Protect, Malaysia’s progressive mobile first digital lifestyle insurer.

TBWA\Malaysia is the first creative agency Tune Protect has appointed, with the objective to create a cohesive sustainable brand positioning aligned with their brand’s goal of being the preferred lifestyle insurer for Millennials, Gen Z and small and medium enterprises (SME).

Said Hui Tsin Yee, Chief Executive Officer, TBWA\Malaysia; “Our task is to build a strong brand presence, with emphasis on Tune Protect’s core offering that not only simplifies the entire customer journey but strengthens the consumers interactions by adding value to their everyday lives.

“Across the insurance sector, we discovered many Malaysians’ purchasing decisions are quite traditional, which presented the opportunity to interrupt the conventional path to purchase.”

While Malaysia’s insurance sector is highly competitive, its recovery from shocks of the pandemic is expected to be quick, with growth projected at almost six percent annually for 10 years.*

Said Rohit Nambiar (Rohit), Group Chief Executive Officer Tune Protect Group Berhad: “To achieve our vision of being the lifestyle insurer that everyone loves, and appealing to the digital world and a younger dynamic generation, we felt the timing was right to embark on a larger scale branding exercise and appointed TBWA, our first creative agency, to help us achieve our goal in Malaysia and Thailand.

Our focus is to offer innovative digital insurance solutions that are bite-sized and hyper-personalised while providing a seamless consumer experience through online direct to consumer channels (mobile app and website) as well as through digital affinity partners’ platforms. The idea is to be available where our customers want us to be, and how best they would like to engage with us,” Rohit concluded.

Tune Protect’s digital first approach augments the entire category experience by simplifying and tailoring policies that are accessible via mobile. TBWA introduced T.P. the Thumb to ‘Click to Start’; a simple three-step approach requiring just three minutes to purchase, three hours to receive a response and three days to receive a claim upon approval. (3-3-3)

Insurance simplified, and it’s all at your fingertips.

“In essence, this is the core idea behind the campaign – to indicate how simple and easy insurance can be, by demonstrating how in control you are as the user, when it comes to insurance. To bring this to life, we utilized a part of our body that puts our choices and wants into action – our thumb.

Continued Yee: “The thumb is a versatile, an easily recognised icon that is associated with mobile, and can be replicated across multiple brand applications, enhancing the customer’s experience with the app.”

The humble thumb has become Tune Protect’s new mascot, which has aptly been named T.P. This thumb not only talks, walks, eats, and watches TV, it also validates how easy it is to look up a suite of plans, sign up, make claims, and more, just by clicking on the Tune Protect app.

Read More

TBWA\Malaysia has been awarded the creative business portfolio for Tune Protect, Malaysia’s progressive mobile first digital lifestyle insurer.

TBWA\Malaysia is the first creative agency Tune Protect has appointed, with the objective to create a cohesive sustainable brand positioning aligned with their brand’s goal of being the preferred lifestyle insurer for Millennials, Gen Z and small and medium enterprises (SME).

Said Hui Tsin Yee, Chief Executive Officer, TBWA\Malaysia; “Our task is to build a strong brand presence, with emphasis on Tune Protect’s core offering that not only simplifies the entire customer journey but strengthens the consumers interactions by adding value to their everyday lives.

“Across the insurance sector, we discovered many Malaysians’ purchasing decisions are quite traditional, which presented the opportunity to interrupt the conventional path to purchase.”

While Malaysia’s insurance sector is highly competitive, its recovery from shocks of the pandemic is expected to be quick, with growth projected at almost six percent annually for 10 years.*

Said Rohit Nambiar (Rohit), Group Chief Executive Officer Tune Protect Group Berhad: “To achieve our vision of being the lifestyle insurer that everyone loves, and appealing to the digital world and a younger dynamic generation, we felt the timing was right to embark on a larger scale branding exercise and appointed TBWA, our first creative agency, to help us achieve our goal in Malaysia and Thailand.

Our focus is to offer innovative digital insurance solutions that are bite-sized and hyper-personalised while providing a seamless consumer experience through online direct to consumer channels (mobile app and website) as well as through digital affinity partners’ platforms. The idea is to be available where our customers want us to be, and how best they would like to engage with us,” Rohit concluded.

Tune Protect’s digital first approach augments the entire category experience by simplifying and tailoring policies that are accessible via mobile. TBWA introduced T.P. the Thumb to ‘Click to Start’; a simple three-step approach requiring just three minutes to purchase, three hours to receive a response and three days to receive a claim upon approval. (3-3-3)

Insurance simplified, and it’s all at your fingertips.

“In essence, this is the core idea behind the campaign – to indicate how simple and easy insurance can be, by demonstrating how in control you are as the user, when it comes to insurance. To bring this to life, we utilized a part of our body that puts our choices and wants into action – our thumb.

Continued Yee: “The thumb is a versatile, an easily recognised icon that is associated with mobile, and can be replicated across multiple brand applications, enhancing the customer’s experience with the app.”

The humble thumb has become Tune Protect’s new mascot, which has aptly been named T.P. This thumb not only talks, walks, eats, and watches TV, it also validates how easy it is to look up a suite of plans, sign up, make claims, and more, just by clicking on the Tune Protect app.

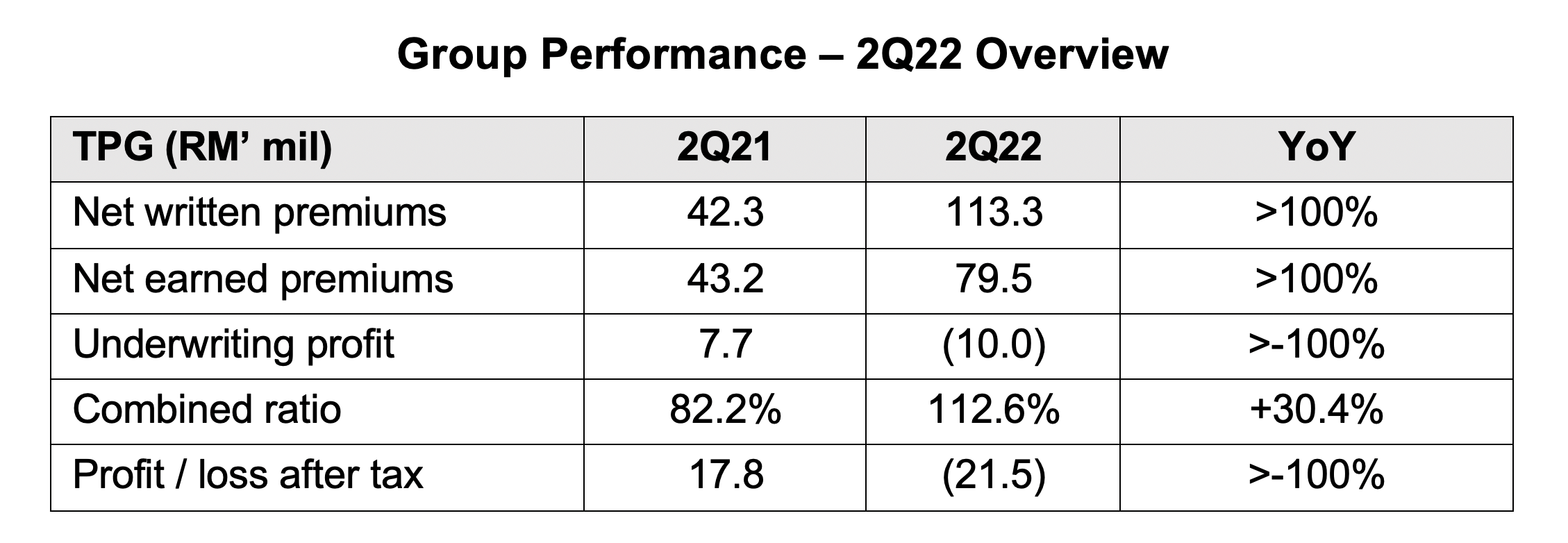

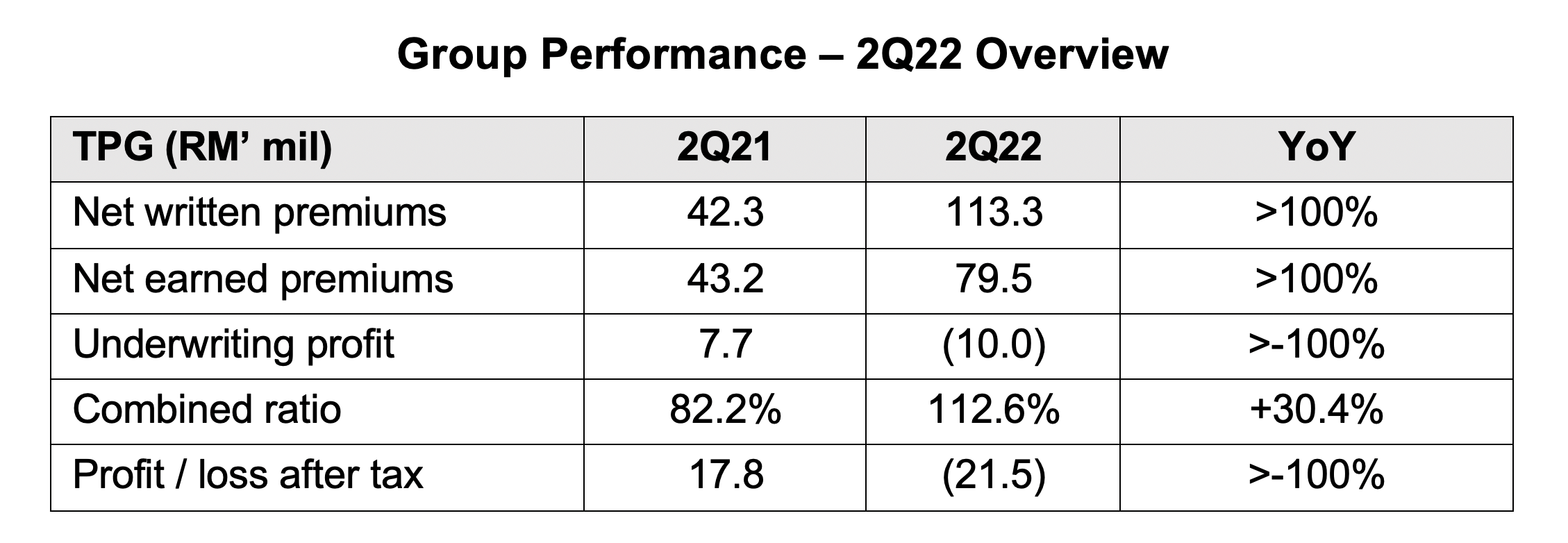

Tune Protect hits record high NWP in 2Q22; exponential growth strain, investments and Covid claims in Thailand weighed on bottom line

Highlights:

The YoY NWP for the Group’s preferred business segments; Health, Lifestyle and SME grew 3.7x, 3.0x and 1.4x, respectively. The growth in Health was encouraged by new accounts secured in Vietnam, Lifestyle was driven by the growth in PA, Motor and Travel, whilst SME grew in its Fire business.

Rohit Nambiar (“Rohit”), Tune Protect Group’s Chief Executive Officer said, “The Group’s 2Q22 results show that we are on the right path of growth. It was our highest quarterly NWP since the Group’s Initial Public Offering (“IPO”). However, despite the commendable NWP and NEP, the Group posted Loss After Tax of RM21.5 million in 2Q22 owing to exponential growth strain, investment losses, as well as share of losses by our associate Tune Protect Thailand (“TPT”).”

Commendable progress in key growth areas The Group continues to improve its retention ratio in the Group’s preferred segments which are Health, Lifestyle and SME in line with its strategy to achieve retention upwards of 70% for all Lines of Business (“LOB”). In 2Q22, the Group’s retention ratio was on track, rising 22% YoY to 55%. Its ASEAN expansion is going from strength to strength with 2 new insurance partners secured in Vietnam.

The Group’s expense ratio has significantly reduced YoY in line with the plan from 58.2% to 35.2%, driven by its strong growth story.

The Group is accelerating its mobile strategy through simple, and affordable offerings via its mobile applications in Malaysia and Thailand. New retail products available in the mobile apps included 2 Health and 1 Travel products. A Health Tech offering, integrated with the mobile app will also be made available by 4Q22.

Claims expected to normalise “Currently, motor claims are normalising and at pre-Covid levels, whilst travel in the region has yet to fully recover. Growth was substituted by the Personal Accident (“PA”) segment which has a higher claims profile than travel although still profitable. But with a lower margin profile,” said Rohit.

TPT impacted by high Covid claims TPT’s losses were attributed to the exceptionally high Covid claims, though it is gradually stabilising in line with the overall improvement in Thailand’s Covid infection rate observed during the current quarter. Nevertheless, the Group remains cautious that the financial performance of TPT may continue to be challenging in the coming quarters.

Maintains investment defensive stance on market uncertainties The Group’s portfolio losses were mainly from Asia Pacific equity markets which reflected the lagging inflationary pressure and adjustments to higher interest rate environment in the region. Year-to-Date (“YTD”), the US Federal Reserve (“US Fed”) has hiked interest rates by 200 basis points (“bps”) to 2.5% and the market is expecting interest rates to rise further to 3.5% by year-end.

“Market uncertainties will continue as the US Fed is still battling inflation. Headwinds in China added another dimension to the market turbulence. Our stance for the next half of the year remains defensive,” Rohit concluded.

Read More

- Strong quarterly NWP in 2Q22, grew 3x – highest since IPO

- Key growth areas on track to meet objectives by end of 2023

- Number of policies issued grew by more than 50% YoY

- Bottom line impacted by exponential growth strain, investment losses, as well as losses by Thailand associate

- Commission ratio expected to normalise in 2H22 as premiums are earned

- Investment defensive stance remains for 2022 due to prevailing market uncertainties

The YoY NWP for the Group’s preferred business segments; Health, Lifestyle and SME grew 3.7x, 3.0x and 1.4x, respectively. The growth in Health was encouraged by new accounts secured in Vietnam, Lifestyle was driven by the growth in PA, Motor and Travel, whilst SME grew in its Fire business.

Rohit Nambiar (“Rohit”), Tune Protect Group’s Chief Executive Officer said, “The Group’s 2Q22 results show that we are on the right path of growth. It was our highest quarterly NWP since the Group’s Initial Public Offering (“IPO”). However, despite the commendable NWP and NEP, the Group posted Loss After Tax of RM21.5 million in 2Q22 owing to exponential growth strain, investment losses, as well as share of losses by our associate Tune Protect Thailand (“TPT”).”

Commendable progress in key growth areas The Group continues to improve its retention ratio in the Group’s preferred segments which are Health, Lifestyle and SME in line with its strategy to achieve retention upwards of 70% for all Lines of Business (“LOB”). In 2Q22, the Group’s retention ratio was on track, rising 22% YoY to 55%. Its ASEAN expansion is going from strength to strength with 2 new insurance partners secured in Vietnam.

The Group’s expense ratio has significantly reduced YoY in line with the plan from 58.2% to 35.2%, driven by its strong growth story.

The Group is accelerating its mobile strategy through simple, and affordable offerings via its mobile applications in Malaysia and Thailand. New retail products available in the mobile apps included 2 Health and 1 Travel products. A Health Tech offering, integrated with the mobile app will also be made available by 4Q22.

Claims expected to normalise “Currently, motor claims are normalising and at pre-Covid levels, whilst travel in the region has yet to fully recover. Growth was substituted by the Personal Accident (“PA”) segment which has a higher claims profile than travel although still profitable. But with a lower margin profile,” said Rohit.

TPT impacted by high Covid claims TPT’s losses were attributed to the exceptionally high Covid claims, though it is gradually stabilising in line with the overall improvement in Thailand’s Covid infection rate observed during the current quarter. Nevertheless, the Group remains cautious that the financial performance of TPT may continue to be challenging in the coming quarters.

Maintains investment defensive stance on market uncertainties The Group’s portfolio losses were mainly from Asia Pacific equity markets which reflected the lagging inflationary pressure and adjustments to higher interest rate environment in the region. Year-to-Date (“YTD”), the US Federal Reserve (“US Fed”) has hiked interest rates by 200 basis points (“bps”) to 2.5% and the market is expecting interest rates to rise further to 3.5% by year-end.

“Market uncertainties will continue as the US Fed is still battling inflation. Headwinds in China added another dimension to the market turbulence. Our stance for the next half of the year remains defensive,” Rohit concluded.

Tune Protect Malaysia Launches Its First Critical Illness Product, Critical Safe+, An Affordable And Flexible Online Health Insurance

- Affordable and flexible – option to stack based on required coverages and budget; reaffirm the strong customer-focused approach

- Tune Protect commits to paying an additional 1% of the sum insured for claims paid beyond 3 working days from the approval date, in line with its 3:3:3 commitment

- Provides ease and convenience through a fully digital customer journey; renews the idea of health insurance for the Millennials and Zillennials

- The ideal Health insurance – heavily associated to customers lifestyle choices

Critical Safe+ reaffirms the Company’s strong customer-focused approach by providing the option to customers to stack and customise their Health coverage based on their lifestyle needs and budget, in line with the Group’s aspiration of being the lifestyle insurer that everyone loves.

Tune Protect has a 3:3:3 commitment where customers can buy in 3 minutes, receive a response in 3 hours, and get their claims paid in 3 working days1. In conjunction with the launch of Critical Safe+, the Company is committing to paying an additional 1% of the sum insured if customers do not receive their claims in 3 working days from the approval date.

The end-to-end fully digital customer journey further reiterates the lifestyle insurer aspiration as the Group intends to target the digitally savvy Millennials and Zillennials.

According to the National Health and Morbidity Survey 20192, data showed that only 22% of the population are insured with personal health insurance (PHI), with 36% of the uninsured population claiming that PHI is not necessary and a staggering 43% of them unable to afford PHI.

Jubin Mehta (“Jubin”), Chief Executive Officer of Tune Protect Malaysia echoed the sentiment, “The current Malaysian economic climate is causing financial burnout on the working population. The increasing cost of living and escalating medical cost are not mirrored in the standard of living, where individuals are prone to health issues and illnesses. The rising costs of healthcare facilities and result-oriented working lifestyles implies negligence on health. With Critical Safe+, customers can customise their insurance plan based on their budget and obtain the necessary financial protection against these critical illnesses. Leveraging on digital, we hope to expedite customers insurance journey and appeal to the Millennials and Zillennials.

About Critical Safe+ Critical Safe+ comes in three different options, which are; Top 2, Top 5, and all 39 critical illnesses with sum insured from as low as RM30,000 up to RM200,000. Customers can choose any of these three options based on their coverage needs and budget. All three options cover Advanced Stages of critical illnesses with a 100% pay-out upon diagnosis. For customers who wish to enhance their protection, they can opt for the Top 5 or all 39 critical illnesses options which give them the flexibility to add on Early Stage Cover and Diabetic Care Disease with additional premiums to their main plans. Early Stage Cover pays out 50% of the sum insured upon diagnosis, whilst Diabetic Care Disease consists of an additional sum insured of up to RM50,000.

“The provision of options allows the flexibility for our customers to decide the extent of coverage, sum insured, and optional add-ons. This flexibility reverberates the notion that Customer Knows Best and they are free to decide on the plans that are optimal for them, which may not necessarily be as expansive or as costly,” Jubin added.

The Top 2 option insures customers against Heart Attack and Cancer; Top 5 for Heart Attack, Cancer, Stroke, Serious Coronary Artery Disease, and Kidney Failure; and all 39 critical illnesses option covers a more comprehensive list of critical illnesses.

Critical Safe+ is made available online through Tune Protect’s website and mobile app, and all purchases online will be eligible for a 15% discount. The claiming procedure is also fast and easy as customers can claim through the same online channels, making the journey hassle-free and convenient. In addition to that, customers can also opt for a monthly premium payment to ease their financial commitment.

Simplifying Insurance Through Digital According to the Department of Statistics of Malaysia3, Millennials and Zillennials formulate 69.6% of the total population in Malaysia. The overall group productivity and contribution to the GDP is valuable. The solution lies in transforming the insurance buying process through digitalisation, enabling the millennials and Zillennials to obtain insurance protection. There is a need to simplify the insurance journey including eliminating the rigorous underwriting process, and hyper-personalising insurance solutions to make insurance buying an engaging rather than a prescriptive process.

“Critical Safe+ is a much-awaited addition to our Health portfolio, one of the three key business pillars for the Group. This is a tangible outcome of our efforts to further diversify the business, particularly in the Health segment. Our robust digital and technology capabilities have been one of the key success factors in our go-to market strategy and there will be more exciting propositions that we will be rolling out such as Health Tech proposition to complement our Health insurance offerings,” said Rohit Nambiar (“Rohit”), Group Chief Executive Officer of Tune Protect.

Sustainability In Action On a sustainability front, Tune Protect pledges to contribute RM6 for every Critical Safe+ policy sold to Yayasan Chow Kit’s children health fund, Madhya’s Gift which was set up by Yayasan Chow Kit to provide healthcare to children from less privileged families who are in need of medical treatment.

Customers who purchase Critical Safe+ will also receive RM50 credit in their e-wallet in a special launch campaign that ends 30 September 2022.

For more information or to purchase Critical Safe+, please visit the Company’s website or download the Tune Protect’s mobile app from the Apple App Store or Google Play Store.

1 Terms and conditions apply

2 National Health & Morbidity Survey

3 DOSM Statistics

Tune Protect’s post-lockdown recovery continues with 1Q22 NWP at its highest since 2016

Highlights:

KUALA LUMPUR, 19 MAY 2022 – Tune Protect Group Berhad (“Tune Protect” or “Group”; TUNEPRO, 5230) started its new financial year on a strong footing by posting solid growth for Net Written Premiums (“NWP”). NWP rose by 37.2% year-on-year (“YoY”) to touch RM 82.3 million.

Rohit Nambiar (“Rohit”), Tune Protect Group’s Chief Executive Officer said, “The Group’s 1Q22 performance is evidence of a positive post-lockdown recovery and a testament to our 2021-2023 strategy in action. However, we are impacted by the difficult investment climate, and we will continue to watch it closely with a focus on a more conservative approach.”

Net investment loss improved YoY, but it continued to record fair value losses. Our share of results from the Group’s associate company, Tune Protect Thailand was impacted by claims arising from the effects of Covid.

Notes:

The NWP growth of 37.2% YoY is the highest quarterly NWP since 2016 and this was led by the Group’s Lifestyle pillar, particularly in the PA and Motor segments which recorded an increase of RM11.2 million and RM9.5 million respectively. The PA segment which was driven by the Group’s Tenang PA Care contributed close to 50% of the Lifestyle NWP growth generated through digital and other partners. Tenang PA Care was launched in February this year and is aligned with the Group’s ESG commitment in supporting the B40 segment. The Group had also reduced its Hull portfolio as planned in 1Q22.

“We anticipate growth in the Health pillar with the upcoming launch of a new critical illness product slated for 3Q22. Commercial pillar will continue to taper as per our plan to exit the Aviation and Hull business,” said Rohit.

Growth amid market volatility

The Group’s performance in 1Q22 was commendable given persistent market volatility in 1Q22. On 4 May 2022, the US Federal Reserve (“Fed”) announced a rate hike of 0.5% and guided that it would begin quantitative tightening on 1 June 2022 to combat rising inflation. Risk appetite across almost all major asset classes, whether it be bond or equities have been affected by the bearish US treasuries market and a hawkish Fed. Consequently, it is anticipated that the current risk-off sentiments will continue to dominate the market.

“Moving forward, any recovery in both the bond and equity markets are only expected to happen once the impact of the Russian-Ukraine conflict dissipates and the aggressiveness of the Fed is clarified and priced in fully, most likely in 2H22. In the meantime, our portfolio remains on the defensive and is shielded from extreme volatility as we have reduced our overall fixed income duration to around 3 years,” said Rohit.

On a positive note, the Group’s various strategic partnerships have started to yield strong results and NWP contribution. NWP contribution from digital partnerships and eCommerce grew YoY from RM29.3 million in 1Q21 to RM39.2 million in 1Q22. It currently has 58 business partners, including 10 new partners secured in 1Q22 namely Mediven, and Instahome, among others. Mediven offers COVID-19 test kits with insurance coverage, including COVID-19 death and permanent disability, whilst Instahome’s landlord insurance provides coverage for homeowners from rental liabilities such as unpaid rent, property damages and theft.

Read More

- 1Q22 NWP up 37.2%, NEP up 10.9% YoY

- Group recorded an underwriting profit, but its overall bottom-line was impacted by continued challenges in the investment markets coupled with increased claims on its Health book in Thailand from the Omicron wave

- Group’s customer base stands at 1.5 million unique customers as at 1Q22 and its eCommerce business in Malaysia and Thailand both recorded 8.5x and 12.1x growth rates in terms of policies sold YoY

- Growth led by Lifestyle pillar’s PA and Motor segments

- Strategic partnerships yielding NWP contribution; 58 business partners to date, including 10 new partners in 1Q22

KUALA LUMPUR, 19 MAY 2022 – Tune Protect Group Berhad (“Tune Protect” or “Group”; TUNEPRO, 5230) started its new financial year on a strong footing by posting solid growth for Net Written Premiums (“NWP”). NWP rose by 37.2% year-on-year (“YoY”) to touch RM 82.3 million.

Rohit Nambiar (“Rohit”), Tune Protect Group’s Chief Executive Officer said, “The Group’s 1Q22 performance is evidence of a positive post-lockdown recovery and a testament to our 2021-2023 strategy in action. However, we are impacted by the difficult investment climate, and we will continue to watch it closely with a focus on a more conservative approach.”

Net investment loss improved YoY, but it continued to record fair value losses. Our share of results from the Group’s associate company, Tune Protect Thailand was impacted by claims arising from the effects of Covid.

Notes:

- Aggregate of investment income, realised gains and losses & fair value gains and losses

- Share of results of an associate (TPT) and a joint venture company (TP EMEIA)

The NWP growth of 37.2% YoY is the highest quarterly NWP since 2016 and this was led by the Group’s Lifestyle pillar, particularly in the PA and Motor segments which recorded an increase of RM11.2 million and RM9.5 million respectively. The PA segment which was driven by the Group’s Tenang PA Care contributed close to 50% of the Lifestyle NWP growth generated through digital and other partners. Tenang PA Care was launched in February this year and is aligned with the Group’s ESG commitment in supporting the B40 segment. The Group had also reduced its Hull portfolio as planned in 1Q22.

“We anticipate growth in the Health pillar with the upcoming launch of a new critical illness product slated for 3Q22. Commercial pillar will continue to taper as per our plan to exit the Aviation and Hull business,” said Rohit.

Growth amid market volatility

The Group’s performance in 1Q22 was commendable given persistent market volatility in 1Q22. On 4 May 2022, the US Federal Reserve (“Fed”) announced a rate hike of 0.5% and guided that it would begin quantitative tightening on 1 June 2022 to combat rising inflation. Risk appetite across almost all major asset classes, whether it be bond or equities have been affected by the bearish US treasuries market and a hawkish Fed. Consequently, it is anticipated that the current risk-off sentiments will continue to dominate the market.

“Moving forward, any recovery in both the bond and equity markets are only expected to happen once the impact of the Russian-Ukraine conflict dissipates and the aggressiveness of the Fed is clarified and priced in fully, most likely in 2H22. In the meantime, our portfolio remains on the defensive and is shielded from extreme volatility as we have reduced our overall fixed income duration to around 3 years,” said Rohit.

On a positive note, the Group’s various strategic partnerships have started to yield strong results and NWP contribution. NWP contribution from digital partnerships and eCommerce grew YoY from RM29.3 million in 1Q21 to RM39.2 million in 1Q22. It currently has 58 business partners, including 10 new partners secured in 1Q22 namely Mediven, and Instahome, among others. Mediven offers COVID-19 test kits with insurance coverage, including COVID-19 death and permanent disability, whilst Instahome’s landlord insurance provides coverage for homeowners from rental liabilities such as unpaid rent, property damages and theft.

PHM and MXM International Sdn Bhd Partner with Tune Protect for Greater Choice of Lifestyle Protections in MediSavers App

The new products launch includes ePASavers Easy, MediSavers eTravelSavers, and eHomeSavers Easy

Petaling Jaya, 14 April 2022 – Pathlab Health Management (M) Sdn Bhd (PHM) and MXM International Sdn Bhd (MXM) today announced a strategic partnership with Tune Protect to provide a variety of protection choices in the lifestyle category to cater to a mass audience.

A Memorandum of Collaboration was signed today at MXM Tower by Dato’ Marcus Kam, Group President and Chief Executive Officer of PHM and MXM, Mr. Sam Tang, Chief Operating Officer of MXM, Mr. Rohit Nambiar, Group CEO of Tune Protect Group Berhad, Dr. Raj Kumar Maharajah, Secretary of KOOP MMA and Mr. Christopher Chan Hooi Guan, Director of eMedAsia.

MXM, through its healthcare digital platform app, MediSavers will be making the new products: ePASavers Easy, eTravelSavers (Inbound and Outbound) and eHomeSavers Easy available through the app in a scheduled release in that order.

The launch of MediSavers ePASavers Easy allows people to live a fulfilled life without worry, as it is designed to provide the best protection for them and their loved ones against unexpected personal accidents. With numerous benefits at an affordable yearly premium, ePASavers will shield family members from financial strain in the event of a calamity.

As international borders have now reopened, and Malaysia is welcoming foreign tourists again, PHM, MXM and Tune Protect are looking for convenient ways to protect travellers when they travel domestically and internationally. With the launch of MediSavers eTravelSavers Inbound, tourists who are travelling to Malaysia will enjoy special coverage which includes COVID-19 medical expenses, while fulfilling the mandatory Malaysia immigration law of having COVID-19 insurance when travelling.

MediSavers eTravelSavers Outbound program covers tourist’s medical expenses, trip cancellations, flight delays, COVID-19 medical protection and more while fulfilling the international travel requirements.

In line with this, MediSavers collaborates with KOOP MMA, together with its digital platform under eMedAsia, www.traveller.emedasia.com which offers pre-booking for RTK-Antigen and travel insurance services within eMedAsia platform. “This will reduce congestion at airports, as incoming travellers can now pre-book online for professional RTK-Antigen tests at private clinics”, says Kooperasi Persatuan Perubatan Malaysia (KOOP MMA).

Even more exciting is the establishment of MediSavers eHomeSavers Easy, which provides a peace of mind for both homeowners and tenants to protect their home building, home contents or personal items from unexpected disasters such as fire, flood, burst pipes and other events.

“Protecting our members is not the only goal. By providing these extensive sustainable products, we are creating the perfect digital platform to suit the market’s needs and allows our members to upgrade their lifestyle without worrying about financial constraint because we are here to provide the best coverage for them”, said Dato’ Marcus Kam.

In addition to that, MediSavers has also announced its first referral program called Refer and Reward which enables members to earn commissions through new sign-ups or renewals.

“In this program, an advisor or a member can simply share a referral link and invite people to download the MediSavers App and receive rewards once a new user registered. This special announcement will benefit the advisors at most who have been supporting MXM and MediSavers relentlessly all this while”, said Sam Tang.

Rohit Nambiar added, “This strategic partnership will enable Tune Protect to provide protection to PHM and MXM’s existing and growing members. By leveraging on their network, we want to grow our reach into new customer segments to provide simplified, accessible and digital-friendly insurance. We are excited to have the opportunity to strengthen our collaboration to deliver more value to its growing base by providing our insurance solutions for better financial security and ultimately improve their lives.”

Read More

Petaling Jaya, 14 April 2022 – Pathlab Health Management (M) Sdn Bhd (PHM) and MXM International Sdn Bhd (MXM) today announced a strategic partnership with Tune Protect to provide a variety of protection choices in the lifestyle category to cater to a mass audience.

A Memorandum of Collaboration was signed today at MXM Tower by Dato’ Marcus Kam, Group President and Chief Executive Officer of PHM and MXM, Mr. Sam Tang, Chief Operating Officer of MXM, Mr. Rohit Nambiar, Group CEO of Tune Protect Group Berhad, Dr. Raj Kumar Maharajah, Secretary of KOOP MMA and Mr. Christopher Chan Hooi Guan, Director of eMedAsia.

MXM, through its healthcare digital platform app, MediSavers will be making the new products: ePASavers Easy, eTravelSavers (Inbound and Outbound) and eHomeSavers Easy available through the app in a scheduled release in that order.

The launch of MediSavers ePASavers Easy allows people to live a fulfilled life without worry, as it is designed to provide the best protection for them and their loved ones against unexpected personal accidents. With numerous benefits at an affordable yearly premium, ePASavers will shield family members from financial strain in the event of a calamity.

As international borders have now reopened, and Malaysia is welcoming foreign tourists again, PHM, MXM and Tune Protect are looking for convenient ways to protect travellers when they travel domestically and internationally. With the launch of MediSavers eTravelSavers Inbound, tourists who are travelling to Malaysia will enjoy special coverage which includes COVID-19 medical expenses, while fulfilling the mandatory Malaysia immigration law of having COVID-19 insurance when travelling.

MediSavers eTravelSavers Outbound program covers tourist’s medical expenses, trip cancellations, flight delays, COVID-19 medical protection and more while fulfilling the international travel requirements.

In line with this, MediSavers collaborates with KOOP MMA, together with its digital platform under eMedAsia, www.traveller.emedasia.com which offers pre-booking for RTK-Antigen and travel insurance services within eMedAsia platform. “This will reduce congestion at airports, as incoming travellers can now pre-book online for professional RTK-Antigen tests at private clinics”, says Kooperasi Persatuan Perubatan Malaysia (KOOP MMA).

Even more exciting is the establishment of MediSavers eHomeSavers Easy, which provides a peace of mind for both homeowners and tenants to protect their home building, home contents or personal items from unexpected disasters such as fire, flood, burst pipes and other events.

“Protecting our members is not the only goal. By providing these extensive sustainable products, we are creating the perfect digital platform to suit the market’s needs and allows our members to upgrade their lifestyle without worrying about financial constraint because we are here to provide the best coverage for them”, said Dato’ Marcus Kam.

In addition to that, MediSavers has also announced its first referral program called Refer and Reward which enables members to earn commissions through new sign-ups or renewals.

“In this program, an advisor or a member can simply share a referral link and invite people to download the MediSavers App and receive rewards once a new user registered. This special announcement will benefit the advisors at most who have been supporting MXM and MediSavers relentlessly all this while”, said Sam Tang.

Rohit Nambiar added, “This strategic partnership will enable Tune Protect to provide protection to PHM and MXM’s existing and growing members. By leveraging on their network, we want to grow our reach into new customer segments to provide simplified, accessible and digital-friendly insurance. We are excited to have the opportunity to strengthen our collaboration to deliver more value to its growing base by providing our insurance solutions for better financial security and ultimately improve their lives.”

Mediven® and Tune Protect team up to offer Diagnostic Screening and COVID-19 insurance coverage via MyDocLabTM

KUALA LUMPUR, April 13 – Medical Innovation Ventures Sdn. Bhd. (Mediven®), Tune Protect and MyDocLabTM today officially launched their community care collaboration which offers COVID-19 insurance coverage and diagnostic screening via mobile app, MyDocLabTM.

The unique tripartite collaboration is touted as a first in the market with the merging of innovation, insurance protection and diagnostic screening. Mediven® test kit users can now enjoy the added bonus of insurance coverage at no extra costs.

Mediven® Executive Director, En Ariff Ismail explained, “This initiative is timely as the nation moves into the endemic phase and communities learn to live with the virus. Our Community Care Collaboration is designed to offer peace of mind and double protection; all within convenience of one’s mobile phone. Users of Mediven®’s ProDetect® self-test kits will receive an allowance if tested positive for COVID-19 Category three and above. Users will also be protected with accidental death and total permanent disability benefits. The coverage is valid for 14 days upon submission of their test results via MyDocLab.

Mediven®, a Penang-based medical diagnostic company which develops, manufactures, and markets advanced high quality clinical diagnostic molecular and rapid tests, is the manufacturer of ProDetect® self-test kits, approved by the Malaysia Medical Device Authority (MDA).

Explaining Tune Protect’s involvement, Group CEO, Mr Rohit Nambiar commented, “Tune Protect’s partnership in this collaboration is very much in line with our business aspirations. We aim to make insurance simplified and accessible for everyone. With the power of technology and through this collaboration, we are one step closer to providing protection anytime, anywhere at the convenience of the fingertips. We are truly honoured to be the official insurance partner to offer value added insurance protection to Mediven® Covid test kit users which will be a relief for Covid positive patients.”

Mediven® Operations Director, Dr Lim Li Sze, added, “Protection is key in everyone’s mind as we go through this trying and prolonged health challenge. This community care collaboration allows us to extend double protection in terms of diagnostic screening and insurance coverage to protect ourselves, our families, our workplaces and the community at large.”

MyDocLabTM users can also tap on the multi-featured digital platform to conduct virtually-supervised screenings for Medical Device Authority (MDA) approved test kits, made possible through partnerships with select private clinics and laboratories. Travellers arriving in Malaysia who must undergo a professionally administered RTK within 24 hours of arrival can also opt to perform their self-test within the comforts of their home or quarantine centre via the app. Same day result anytime, anywhere are guaranteed.

In addition, the app also allows bookings for real-time PCR, rapid antigen and post-vaccination neutralising antibody tests at clinics and laboratories. Travellers may also purchase travel insurance with a COVID-19 cover as required by the Malaysian government.

Additionally, Human Resource managers of corporate companies will also find the MyDocLabforWork feature helpful as it essentially helps companies effectively manage and track their employees’ health status through a hassle-free process.

Dr Lim said that they are working closely with partner pharmacies to educate consumers on the double protection of insurance and diagnostic screening offered to assist them in these endemic times. Mediven® ProDetect® COVID-19 test kits (saliva or nasal formats) are available in most major chain pharmacies and retails outlets such as Alpro, AMPM, CARiNG, Georgetown, Watsons, Wellings, Be Pharmacy and 7-Eleven.

Read More

The unique tripartite collaboration is touted as a first in the market with the merging of innovation, insurance protection and diagnostic screening. Mediven® test kit users can now enjoy the added bonus of insurance coverage at no extra costs.

Mediven® Executive Director, En Ariff Ismail explained, “This initiative is timely as the nation moves into the endemic phase and communities learn to live with the virus. Our Community Care Collaboration is designed to offer peace of mind and double protection; all within convenience of one’s mobile phone. Users of Mediven®’s ProDetect® self-test kits will receive an allowance if tested positive for COVID-19 Category three and above. Users will also be protected with accidental death and total permanent disability benefits. The coverage is valid for 14 days upon submission of their test results via MyDocLab.

Mediven®, a Penang-based medical diagnostic company which develops, manufactures, and markets advanced high quality clinical diagnostic molecular and rapid tests, is the manufacturer of ProDetect® self-test kits, approved by the Malaysia Medical Device Authority (MDA).

Explaining Tune Protect’s involvement, Group CEO, Mr Rohit Nambiar commented, “Tune Protect’s partnership in this collaboration is very much in line with our business aspirations. We aim to make insurance simplified and accessible for everyone. With the power of technology and through this collaboration, we are one step closer to providing protection anytime, anywhere at the convenience of the fingertips. We are truly honoured to be the official insurance partner to offer value added insurance protection to Mediven® Covid test kit users which will be a relief for Covid positive patients.”

Mediven® Operations Director, Dr Lim Li Sze, added, “Protection is key in everyone’s mind as we go through this trying and prolonged health challenge. This community care collaboration allows us to extend double protection in terms of diagnostic screening and insurance coverage to protect ourselves, our families, our workplaces and the community at large.”

MyDocLabTM users can also tap on the multi-featured digital platform to conduct virtually-supervised screenings for Medical Device Authority (MDA) approved test kits, made possible through partnerships with select private clinics and laboratories. Travellers arriving in Malaysia who must undergo a professionally administered RTK within 24 hours of arrival can also opt to perform their self-test within the comforts of their home or quarantine centre via the app. Same day result anytime, anywhere are guaranteed.

In addition, the app also allows bookings for real-time PCR, rapid antigen and post-vaccination neutralising antibody tests at clinics and laboratories. Travellers may also purchase travel insurance with a COVID-19 cover as required by the Malaysian government.

Additionally, Human Resource managers of corporate companies will also find the MyDocLabforWork feature helpful as it essentially helps companies effectively manage and track their employees’ health status through a hassle-free process.

Dr Lim said that they are working closely with partner pharmacies to educate consumers on the double protection of insurance and diagnostic screening offered to assist them in these endemic times. Mediven® ProDetect® COVID-19 test kits (saliva or nasal formats) are available in most major chain pharmacies and retails outlets such as Alpro, AMPM, CARiNG, Georgetown, Watsons, Wellings, Be Pharmacy and 7-Eleven.

PropTech Startup Instahome Partners Tune Protect To Offer First Complimentary Landlord Insurance

Kuala Lumpur, Malaysia — 13 April 2022 – Catcha Group-backed real estate technology company, Instahome Sdn Bhd (Instahome) has announced its partnership with Tune Protect Malaysia (Tune Protect) to offer complimentary landlord insurance for worry-free rental. The newly launched landlord insurance is the first ever in Malaysia where the landlord is able to collect security deposits at the beginning of the tenancy agreement and also secure free insurance coverage.

The landlord insurance aims to provide additional reassurance for potential financial loss related to rental properties rented out via the Instahome platform. It covers homeowners from rental liabilities such as unpaid rent, property damages and theft.

The introduction of landlord insurance comes after extensive market research conducted by Instahome, where more than 70% of landlords expressed interest in a product that safeguards their investment properties.

Eric Tan Leong Yit (Eric), CEO and Co-Founder of Instahome shared that although homeowners hold deposits, they still worry about property damages and stolen furniture from runaway tenants.

“We are doing this to bring landlords the ultimate peace of mind. Based on landlord surveys, we believe a combination of traditional rental deposits and additional insurance brings the best of both worlds. Collecting deposit alone might not be enough as loss of rental and property damages can exceed the deposit amount; while a zero deposit insurance package is expensive and time-consuming, and landlords are often faced with tenants that do not keep the property well maintained.”

“We heard our landlords, and this is why we are thrilled to be partnering with Tune Protect as it helps us reinforce our commitment to improving our landlord experience,” Eric added.

With the landlord insurance, a homeowner can keep the initial two and a half months’ security deposit collected, and in the event of a tenant runaway, be entitled to receive up to RM1,500 in rental losses, RM500 in legal fees, RM15,000 for malicious damage done to the insured property and RM1,000 for theft by the tenant.

Janet Chin (Janet), Chief Partnership & eCommerce Officer of Tune Protect said, “We are happy to partner with Instahome to empower Malaysian landlords and challenge the archaic renting experience. With Instahome digitising the home rental experience, and Tune Protect complementing the experience with our simplicity and accessibility, we are confident that this partnership will be a gamechanger in the property rental market and improve the quality of the rental ecosystem.”

“Our wide array of insurance products means Instahome can offer added benefits by embedding Tune Protect products into their purchase path to provide customers with the relevant coverages that meet their lifestyle needs. It is all about simplifying the insurance journey for customers and we are happy to meet them where it is most convenient for them, such as the Instahome digital platform,” Janet continued.

Packaging insurance into Instahome’s offerings simplifies the rental journey for homeowners, offering them end-to-end support. Landlords will receive full coverage support which includes: 1) eviction support with Instahome guiding the landlords throughout the claims process in the court and connecting them with panel lawyers; 2) 7 days a week swift customer service to handle queries; 3) free rental collection system that sends rent payment reminders and rewards on-time paying tenants and; 4) maintenance support to provide landlords with reliable contractor recommendations and special rates through Instahome’s partnership with Kaodim.

Read More

The landlord insurance aims to provide additional reassurance for potential financial loss related to rental properties rented out via the Instahome platform. It covers homeowners from rental liabilities such as unpaid rent, property damages and theft.

The introduction of landlord insurance comes after extensive market research conducted by Instahome, where more than 70% of landlords expressed interest in a product that safeguards their investment properties.

Eric Tan Leong Yit (Eric), CEO and Co-Founder of Instahome shared that although homeowners hold deposits, they still worry about property damages and stolen furniture from runaway tenants.

“We are doing this to bring landlords the ultimate peace of mind. Based on landlord surveys, we believe a combination of traditional rental deposits and additional insurance brings the best of both worlds. Collecting deposit alone might not be enough as loss of rental and property damages can exceed the deposit amount; while a zero deposit insurance package is expensive and time-consuming, and landlords are often faced with tenants that do not keep the property well maintained.”

“We heard our landlords, and this is why we are thrilled to be partnering with Tune Protect as it helps us reinforce our commitment to improving our landlord experience,” Eric added.

With the landlord insurance, a homeowner can keep the initial two and a half months’ security deposit collected, and in the event of a tenant runaway, be entitled to receive up to RM1,500 in rental losses, RM500 in legal fees, RM15,000 for malicious damage done to the insured property and RM1,000 for theft by the tenant.

Janet Chin (Janet), Chief Partnership & eCommerce Officer of Tune Protect said, “We are happy to partner with Instahome to empower Malaysian landlords and challenge the archaic renting experience. With Instahome digitising the home rental experience, and Tune Protect complementing the experience with our simplicity and accessibility, we are confident that this partnership will be a gamechanger in the property rental market and improve the quality of the rental ecosystem.”

“Our wide array of insurance products means Instahome can offer added benefits by embedding Tune Protect products into their purchase path to provide customers with the relevant coverages that meet their lifestyle needs. It is all about simplifying the insurance journey for customers and we are happy to meet them where it is most convenient for them, such as the Instahome digital platform,” Janet continued.

Packaging insurance into Instahome’s offerings simplifies the rental journey for homeowners, offering them end-to-end support. Landlords will receive full coverage support which includes: 1) eviction support with Instahome guiding the landlords throughout the claims process in the court and connecting them with panel lawyers; 2) 7 days a week swift customer service to handle queries; 3) free rental collection system that sends rent payment reminders and rewards on-time paying tenants and; 4) maintenance support to provide landlords with reliable contractor recommendations and special rates through Instahome’s partnership with Kaodim.

Protection for your loved ones with a touch of a button EcoWorld and Tune Protect simplify protection for your home, family and more with EcoWorld Cares

Shah Alam: Property developer Eco World Development Group Berhad (EcoWorld) has launched a comprehensive digital protection plan called EcoWorld Cares, which offers a range of protection under one umbrella. EcoWorld Cares is offered through the book.ecoworld.my/ecoworldcares website – a brand new, fuss free way to protect your home and those that matter to you, all at your fingertips.

The first batch of products were launched in 2020 and featured My Home Protect, My Smart Home Protect and My Maid Protect. Underwritten by Tune Protect Malaysia (Tune Protect), this enabled homeowners and tenants to purchase ad hoc home protection base insurance products for durations ranging from a week to a year.

President and CEO Dato’ Chang Khim Wah said the Group continuously strives to provide the best possible value to its esteemed customers. “With the implementation of our first Insurtech products, made available to the home owners, tenants and investors alike via the EcoWorld Neighbourhood App, we are able to provide an encompassing protection to their homes, themselves and to what they hold dear.

“EcoWorld is constantly working on the pursuit of better, greater ways to complete our customers’ living experience. It is more than just building a premise. It is about co-creating a journey together. The inception of EcoWorld Cares, an umbrella of protection throughout our customers’ journey is in line with our vision of Creating Tomorrow & Beyond,” Chang added.

From the first three products offered in 2020, EcoWorld has expanded this to include newer product offerings to fit in those segments of Pre-Vacant Possession via its Sales Booking Online platform – book.ecoworld.my.

The customer journey experience is dissected into three segments: Point-of-Sales, Pre-Vacant Possession / Evergreen, Post-Sales as seen below:

Chang shared the group was fortunate to have likeminded partners in Tune Protect who underwrites for EcoWorld Cares. “With time being a precious commodity today in practically everyone’s lives, this convenience with just a touch of a button allows one to plan ahead without much hassle,” he added.

Tune Protect’s robust technology and digital capabilities are able to empower its business partners such as EcoWorld by providing the API and other Insurtech services for them to offer insurance products to their customers seamlessly.

“We are delighted to partner with EcoWorld and it is truly heartening to note the effort and commitment the Group has in journeying with its customers. Protection at different stages of one’s life should not be taken lightly and Tune Protect is glad that we are able to make this as simple, convenient, and easy as possible. Our aim is to be the lifestyle insurer that everyone loves, and this partnership allows us to complement the lifestyles of EcoWorld customers,” said Rohit Chandrasekharan Nambiar, Group Chief Executive Officer of Tune Protect.

Chang explains EcoWorld Cares fits into the digital strategy roadmap at EcoWorld’s external end-point, in its engagement with EcoWorld home owners, tenants and investors.

“As part of our EcoWorld digital strategy to digitalise and transform our business in the ever-growing landscape of technology, our efforts to revolutionise our engagements in all stakeholder touchpoints whether internal or external has been an innovative journey,” he said.

The newest plan offered under EcoWorld Cares is the EcoWorld Income Safe PA Plan, which is a personal accident plan designed specifically for EcoWorld buyers to safeguard themselves and loved ones in times of need. Policy holders will be compensated in the event of injuries, disability or death caused by violent, accidental, external and visible events.

“In our effort to answer the needs of our customers, especially in these challenging times, we designed this product to additionally compensate for a potential loss of income due to accidents or a Covid related event. With the addition of EcoWorld Income Safe PA Plan, we have now accomplished our mission in curating a step-by-step coverage throughout our customer’s journey in owning an EcoWorld product,” Chang said.

Read More

The first batch of products were launched in 2020 and featured My Home Protect, My Smart Home Protect and My Maid Protect. Underwritten by Tune Protect Malaysia (Tune Protect), this enabled homeowners and tenants to purchase ad hoc home protection base insurance products for durations ranging from a week to a year.

President and CEO Dato’ Chang Khim Wah said the Group continuously strives to provide the best possible value to its esteemed customers. “With the implementation of our first Insurtech products, made available to the home owners, tenants and investors alike via the EcoWorld Neighbourhood App, we are able to provide an encompassing protection to their homes, themselves and to what they hold dear.

“EcoWorld is constantly working on the pursuit of better, greater ways to complete our customers’ living experience. It is more than just building a premise. It is about co-creating a journey together. The inception of EcoWorld Cares, an umbrella of protection throughout our customers’ journey is in line with our vision of Creating Tomorrow & Beyond,” Chang added.

From the first three products offered in 2020, EcoWorld has expanded this to include newer product offerings to fit in those segments of Pre-Vacant Possession via its Sales Booking Online platform – book.ecoworld.my.

The customer journey experience is dissected into three segments: Point-of-Sales, Pre-Vacant Possession / Evergreen, Post-Sales as seen below:

Chang shared the group was fortunate to have likeminded partners in Tune Protect who underwrites for EcoWorld Cares. “With time being a precious commodity today in practically everyone’s lives, this convenience with just a touch of a button allows one to plan ahead without much hassle,” he added.

Tune Protect’s robust technology and digital capabilities are able to empower its business partners such as EcoWorld by providing the API and other Insurtech services for them to offer insurance products to their customers seamlessly.

“We are delighted to partner with EcoWorld and it is truly heartening to note the effort and commitment the Group has in journeying with its customers. Protection at different stages of one’s life should not be taken lightly and Tune Protect is glad that we are able to make this as simple, convenient, and easy as possible. Our aim is to be the lifestyle insurer that everyone loves, and this partnership allows us to complement the lifestyles of EcoWorld customers,” said Rohit Chandrasekharan Nambiar, Group Chief Executive Officer of Tune Protect.

Chang explains EcoWorld Cares fits into the digital strategy roadmap at EcoWorld’s external end-point, in its engagement with EcoWorld home owners, tenants and investors.

“As part of our EcoWorld digital strategy to digitalise and transform our business in the ever-growing landscape of technology, our efforts to revolutionise our engagements in all stakeholder touchpoints whether internal or external has been an innovative journey,” he said.

The newest plan offered under EcoWorld Cares is the EcoWorld Income Safe PA Plan, which is a personal accident plan designed specifically for EcoWorld buyers to safeguard themselves and loved ones in times of need. Policy holders will be compensated in the event of injuries, disability or death caused by violent, accidental, external and visible events.

“In our effort to answer the needs of our customers, especially in these challenging times, we designed this product to additionally compensate for a potential loss of income due to accidents or a Covid related event. With the addition of EcoWorld Income Safe PA Plan, we have now accomplished our mission in curating a step-by-step coverage throughout our customer’s journey in owning an EcoWorld product,” Chang said.

Tune Protect contributes RM24,000 from online product sales to Sustain Madhya’s Gift Fund

- Tune Protect fulfills its Sustainability commitment, channels contribution towards Madhya’s Gift, Yayasan Chow Kit’s critical healthcare fund for children from online product sales

Representing Tune Protect at the mock cheque presentation ceremony were Rohit Nambiar (“Rohit”), Chief Executive Officer and Yap Hsu Yi, Chief – People & Culture of Tune Protect. Yayasan Chow Kit was represented by Y.A.M Tunku Dato’ Sri Major Zain Al-‘Abidin Ibni Tuanku Muhriz, a member of the Board of Trustees and Y. Bhg. Dato’ Dr. Hartini Zainudin (“Dato’ Tini”), Co-Founder of Yayasan Chow Kit.

“We made several Sustainability commitments in 2021 and one of it includes embedding charity element into our product offerings. Seeing the shift in consumer buying preferences towards the online channels, we started off with our online Health and Lifestyle products last year and pledged our commitment to channel our CSR fund to Madhya’s Gift of Yayasan Chow Kit for every policy sold. This year, we have decided to extend the charity element beyond these two products and include all our online products, except for Travel and PA,” said Rohit.

Tune Protect began collaborating with YCK in 2017 and 2018 on the “Sponsor A Kid Back to School” initiative that saw the sponsorship of school uniforms and major roof leaks repairs. In 2019, Tune Protect sponsored PROBRATS rugby training for YCK kids conducted by COBRA Rugby Club and in 2020, Tune Protect reached out to assist with emergency funds for an accident victim and fire victims. From then on, Tune Protect have consistently journeyed with YCK year on year through various initiatives and with this recent initiative, Tune Protect has taken a step further by incorporating charity elements into its online products to be channeled to Madhya’s Gift Fund.

Y.A.M. Tunku’s Dato’ Sri Major Zain Al-‘Abidin said, “Tune Protect has been supporting YCK for a long time since 2017 and we’re very thankful for their continued support with this significant contribution towards Madhya’s Gift. This fund is particularly important to those in need at this tough economic juncture.”

Dato’ Tini continued, “Madhya’s Gift is Yayasan Chow Kit’s solution to ensure that sick children in Malaysia receive the support and funds needed to access quality and equitable medical services while cutting down the wait. Tune Protect is our first corporate partner to offer unwavering support and financial contribution to ensure we succeed. So far, we have helped 37 very sick children with access to medical services and critical medical help.”

The Group’s Malaysian subsidiary, Tune Protect Malaysia has more than 10 Lifestyle and Health products that are offered on its website and mobile app. Customers who purchase any of these products (except for Travel and PA), will indirectly help to make a difference in the lives of children who need medical and health services. The contribution will be drawn from Tune Protect’s CSR fund, based on the number of policies sold, not from the insurance premiums that customers pay.

Tune Protect has also been partnering with the Lions Club of Petaling Jaya for several years through various initiatives. The most recent collaborations include the sponsorship of food pyramid and COVID-19 prevention essentials to the visually impaired under the care of Malaysian Association for the Blind, food packs to Hospital Shah Alam front liners, sponsorship of a cataract machine to Kuala Lumpur General Hospital and a contribution of RM10,500 to YCK for Madhya’s Gift. The representatives from Lions Club of Petaling Jaya were also present to handover their contribution of RM10,500 to Madhya’s Gift.