KUALA LUMPUR, April 13 – Medical Innovation Ventures Sdn. Bhd. (Mediven®), Tune Protect and MyDocLabTM today officially launched their community care collaboration which offers COVID-19 insurance coverage and diagnostic screening via mobile app, MyDocLabTM.

The unique tripartite collaboration is touted as a first in the market with the merging of innovation, insurance protection and diagnostic screening. Mediven® test kit users can now enjoy the added bonus of insurance coverage at no extra costs.

Mediven® Executive Director, En Ariff Ismail explained, “This initiative is timely as the nation moves into the endemic phase and communities learn to live with the virus. Our Community Care Collaboration is designed to offer peace of mind and double protection; all within convenience of one’s mobile phone. Users of Mediven®’s ProDetect® self-test kits will receive an allowance if tested positive for COVID-19 Category three and above. Users will also be protected with accidental death and total permanent disability benefits. The coverage is valid for 14 days upon submission of their test results via MyDocLab.

Mediven®, a Penang-based medical diagnostic company which develops, manufactures, and markets advanced high quality clinical diagnostic molecular and rapid tests, is the manufacturer of ProDetect® self-test kits, approved by the Malaysia Medical Device Authority (MDA).

Explaining Tune Protect’s involvement, Group CEO, Mr Rohit Nambiar commented, “Tune Protect’s partnership in this collaboration is very much in line with our business aspirations. We aim to make insurance simplified and accessible for everyone. With the power of technology and through this collaboration, we are one step closer to providing protection anytime, anywhere at the convenience of the fingertips. We are truly honoured to be the official insurance partner to offer value added insurance protection to Mediven® Covid test kit users which will be a relief for Covid positive patients.”

Mediven® Operations Director, Dr Lim Li Sze, added, “Protection is key in everyone’s mind as we go through this trying and prolonged health challenge. This community care collaboration allows us to extend double protection in terms of diagnostic screening and insurance coverage to protect ourselves, our families, our workplaces and the community at large.”

MyDocLabTM users can also tap on the multi-featured digital platform to conduct virtually-supervised screenings for Medical Device Authority (MDA) approved test kits, made possible through partnerships with select private clinics and laboratories. Travellers arriving in Malaysia who must undergo a professionally administered RTK within 24 hours of arrival can also opt to perform their self-test within the comforts of their home or quarantine centre via the app. Same day result anytime, anywhere are guaranteed.

In addition, the app also allows bookings for real-time PCR, rapid antigen and post-vaccination neutralising antibody tests at clinics and laboratories. Travellers may also purchase travel insurance with a COVID-19 cover as required by the Malaysian government.

Additionally, Human Resource managers of corporate companies will also find the MyDocLabforWork feature helpful as it essentially helps companies effectively manage and track their employees’ health status through a hassle-free process.

Dr Lim said that they are working closely with partner pharmacies to educate consumers on the double protection of insurance and diagnostic screening offered to assist them in these endemic times. Mediven® ProDetect® COVID-19 test kits (saliva or nasal formats) are available in most major chain pharmacies and retails outlets such as Alpro, AMPM, CARiNG, Georgetown, Watsons, Wellings, Be Pharmacy and 7-Eleven.

All Posts in Category: Press Releases

PropTech Startup Instahome Partners Tune Protect To Offer First Complimentary Landlord Insurance

Kuala Lumpur, Malaysia — 13 April 2022 – Catcha Group-backed real estate technology company, Instahome Sdn Bhd (Instahome) has announced its partnership with Tune Protect Malaysia (Tune Protect) to offer complimentary landlord insurance for worry-free rental. The newly launched landlord insurance is the first ever in Malaysia where the landlord is able to collect security deposits at the beginning of the tenancy agreement and also secure free insurance coverage.

The landlord insurance aims to provide additional reassurance for potential financial loss related to rental properties rented out via the Instahome platform. It covers homeowners from rental liabilities such as unpaid rent, property damages and theft.

The introduction of landlord insurance comes after extensive market research conducted by Instahome, where more than 70% of landlords expressed interest in a product that safeguards their investment properties.

Eric Tan Leong Yit (Eric), CEO and Co-Founder of Instahome shared that although homeowners hold deposits, they still worry about property damages and stolen furniture from runaway tenants.

“We are doing this to bring landlords the ultimate peace of mind. Based on landlord surveys, we believe a combination of traditional rental deposits and additional insurance brings the best of both worlds. Collecting deposit alone might not be enough as loss of rental and property damages can exceed the deposit amount; while a zero deposit insurance package is expensive and time-consuming, and landlords are often faced with tenants that do not keep the property well maintained.”

“We heard our landlords, and this is why we are thrilled to be partnering with Tune Protect as it helps us reinforce our commitment to improving our landlord experience,” Eric added.

With the landlord insurance, a homeowner can keep the initial two and a half months’ security deposit collected, and in the event of a tenant runaway, be entitled to receive up to RM1,500 in rental losses, RM500 in legal fees, RM15,000 for malicious damage done to the insured property and RM1,000 for theft by the tenant.

Janet Chin (Janet), Chief Partnership & eCommerce Officer of Tune Protect said, “We are happy to partner with Instahome to empower Malaysian landlords and challenge the archaic renting experience. With Instahome digitising the home rental experience, and Tune Protect complementing the experience with our simplicity and accessibility, we are confident that this partnership will be a gamechanger in the property rental market and improve the quality of the rental ecosystem.”

“Our wide array of insurance products means Instahome can offer added benefits by embedding Tune Protect products into their purchase path to provide customers with the relevant coverages that meet their lifestyle needs. It is all about simplifying the insurance journey for customers and we are happy to meet them where it is most convenient for them, such as the Instahome digital platform,” Janet continued.

Packaging insurance into Instahome’s offerings simplifies the rental journey for homeowners, offering them end-to-end support. Landlords will receive full coverage support which includes: 1) eviction support with Instahome guiding the landlords throughout the claims process in the court and connecting them with panel lawyers; 2) 7 days a week swift customer service to handle queries; 3) free rental collection system that sends rent payment reminders and rewards on-time paying tenants and; 4) maintenance support to provide landlords with reliable contractor recommendations and special rates through Instahome’s partnership with Kaodim.

Read More

The landlord insurance aims to provide additional reassurance for potential financial loss related to rental properties rented out via the Instahome platform. It covers homeowners from rental liabilities such as unpaid rent, property damages and theft.

The introduction of landlord insurance comes after extensive market research conducted by Instahome, where more than 70% of landlords expressed interest in a product that safeguards their investment properties.

Eric Tan Leong Yit (Eric), CEO and Co-Founder of Instahome shared that although homeowners hold deposits, they still worry about property damages and stolen furniture from runaway tenants.

“We are doing this to bring landlords the ultimate peace of mind. Based on landlord surveys, we believe a combination of traditional rental deposits and additional insurance brings the best of both worlds. Collecting deposit alone might not be enough as loss of rental and property damages can exceed the deposit amount; while a zero deposit insurance package is expensive and time-consuming, and landlords are often faced with tenants that do not keep the property well maintained.”

“We heard our landlords, and this is why we are thrilled to be partnering with Tune Protect as it helps us reinforce our commitment to improving our landlord experience,” Eric added.

With the landlord insurance, a homeowner can keep the initial two and a half months’ security deposit collected, and in the event of a tenant runaway, be entitled to receive up to RM1,500 in rental losses, RM500 in legal fees, RM15,000 for malicious damage done to the insured property and RM1,000 for theft by the tenant.

Janet Chin (Janet), Chief Partnership & eCommerce Officer of Tune Protect said, “We are happy to partner with Instahome to empower Malaysian landlords and challenge the archaic renting experience. With Instahome digitising the home rental experience, and Tune Protect complementing the experience with our simplicity and accessibility, we are confident that this partnership will be a gamechanger in the property rental market and improve the quality of the rental ecosystem.”

“Our wide array of insurance products means Instahome can offer added benefits by embedding Tune Protect products into their purchase path to provide customers with the relevant coverages that meet their lifestyle needs. It is all about simplifying the insurance journey for customers and we are happy to meet them where it is most convenient for them, such as the Instahome digital platform,” Janet continued.

Packaging insurance into Instahome’s offerings simplifies the rental journey for homeowners, offering them end-to-end support. Landlords will receive full coverage support which includes: 1) eviction support with Instahome guiding the landlords throughout the claims process in the court and connecting them with panel lawyers; 2) 7 days a week swift customer service to handle queries; 3) free rental collection system that sends rent payment reminders and rewards on-time paying tenants and; 4) maintenance support to provide landlords with reliable contractor recommendations and special rates through Instahome’s partnership with Kaodim.

Protection for your loved ones with a touch of a button EcoWorld and Tune Protect simplify protection for your home, family and more with EcoWorld Cares

Shah Alam: Property developer Eco World Development Group Berhad (EcoWorld) has launched a comprehensive digital protection plan called EcoWorld Cares, which offers a range of protection under one umbrella. EcoWorld Cares is offered through the book.ecoworld.my/ecoworldcares website – a brand new, fuss free way to protect your home and those that matter to you, all at your fingertips.

The first batch of products were launched in 2020 and featured My Home Protect, My Smart Home Protect and My Maid Protect. Underwritten by Tune Protect Malaysia (Tune Protect), this enabled homeowners and tenants to purchase ad hoc home protection base insurance products for durations ranging from a week to a year.

President and CEO Dato’ Chang Khim Wah said the Group continuously strives to provide the best possible value to its esteemed customers. “With the implementation of our first Insurtech products, made available to the home owners, tenants and investors alike via the EcoWorld Neighbourhood App, we are able to provide an encompassing protection to their homes, themselves and to what they hold dear.

“EcoWorld is constantly working on the pursuit of better, greater ways to complete our customers’ living experience. It is more than just building a premise. It is about co-creating a journey together. The inception of EcoWorld Cares, an umbrella of protection throughout our customers’ journey is in line with our vision of Creating Tomorrow & Beyond,” Chang added.

From the first three products offered in 2020, EcoWorld has expanded this to include newer product offerings to fit in those segments of Pre-Vacant Possession via its Sales Booking Online platform – book.ecoworld.my.

The customer journey experience is dissected into three segments: Point-of-Sales, Pre-Vacant Possession / Evergreen, Post-Sales as seen below:

Chang shared the group was fortunate to have likeminded partners in Tune Protect who underwrites for EcoWorld Cares. “With time being a precious commodity today in practically everyone’s lives, this convenience with just a touch of a button allows one to plan ahead without much hassle,” he added.

Tune Protect’s robust technology and digital capabilities are able to empower its business partners such as EcoWorld by providing the API and other Insurtech services for them to offer insurance products to their customers seamlessly.

“We are delighted to partner with EcoWorld and it is truly heartening to note the effort and commitment the Group has in journeying with its customers. Protection at different stages of one’s life should not be taken lightly and Tune Protect is glad that we are able to make this as simple, convenient, and easy as possible. Our aim is to be the lifestyle insurer that everyone loves, and this partnership allows us to complement the lifestyles of EcoWorld customers,” said Rohit Chandrasekharan Nambiar, Group Chief Executive Officer of Tune Protect.

Chang explains EcoWorld Cares fits into the digital strategy roadmap at EcoWorld’s external end-point, in its engagement with EcoWorld home owners, tenants and investors.

“As part of our EcoWorld digital strategy to digitalise and transform our business in the ever-growing landscape of technology, our efforts to revolutionise our engagements in all stakeholder touchpoints whether internal or external has been an innovative journey,” he said.

The newest plan offered under EcoWorld Cares is the EcoWorld Income Safe PA Plan, which is a personal accident plan designed specifically for EcoWorld buyers to safeguard themselves and loved ones in times of need. Policy holders will be compensated in the event of injuries, disability or death caused by violent, accidental, external and visible events.

“In our effort to answer the needs of our customers, especially in these challenging times, we designed this product to additionally compensate for a potential loss of income due to accidents or a Covid related event. With the addition of EcoWorld Income Safe PA Plan, we have now accomplished our mission in curating a step-by-step coverage throughout our customer’s journey in owning an EcoWorld product,” Chang said.

Read More

The first batch of products were launched in 2020 and featured My Home Protect, My Smart Home Protect and My Maid Protect. Underwritten by Tune Protect Malaysia (Tune Protect), this enabled homeowners and tenants to purchase ad hoc home protection base insurance products for durations ranging from a week to a year.

President and CEO Dato’ Chang Khim Wah said the Group continuously strives to provide the best possible value to its esteemed customers. “With the implementation of our first Insurtech products, made available to the home owners, tenants and investors alike via the EcoWorld Neighbourhood App, we are able to provide an encompassing protection to their homes, themselves and to what they hold dear.

“EcoWorld is constantly working on the pursuit of better, greater ways to complete our customers’ living experience. It is more than just building a premise. It is about co-creating a journey together. The inception of EcoWorld Cares, an umbrella of protection throughout our customers’ journey is in line with our vision of Creating Tomorrow & Beyond,” Chang added.

From the first three products offered in 2020, EcoWorld has expanded this to include newer product offerings to fit in those segments of Pre-Vacant Possession via its Sales Booking Online platform – book.ecoworld.my.

The customer journey experience is dissected into three segments: Point-of-Sales, Pre-Vacant Possession / Evergreen, Post-Sales as seen below:

Chang shared the group was fortunate to have likeminded partners in Tune Protect who underwrites for EcoWorld Cares. “With time being a precious commodity today in practically everyone’s lives, this convenience with just a touch of a button allows one to plan ahead without much hassle,” he added.

Tune Protect’s robust technology and digital capabilities are able to empower its business partners such as EcoWorld by providing the API and other Insurtech services for them to offer insurance products to their customers seamlessly.

“We are delighted to partner with EcoWorld and it is truly heartening to note the effort and commitment the Group has in journeying with its customers. Protection at different stages of one’s life should not be taken lightly and Tune Protect is glad that we are able to make this as simple, convenient, and easy as possible. Our aim is to be the lifestyle insurer that everyone loves, and this partnership allows us to complement the lifestyles of EcoWorld customers,” said Rohit Chandrasekharan Nambiar, Group Chief Executive Officer of Tune Protect.

Chang explains EcoWorld Cares fits into the digital strategy roadmap at EcoWorld’s external end-point, in its engagement with EcoWorld home owners, tenants and investors.

“As part of our EcoWorld digital strategy to digitalise and transform our business in the ever-growing landscape of technology, our efforts to revolutionise our engagements in all stakeholder touchpoints whether internal or external has been an innovative journey,” he said.

The newest plan offered under EcoWorld Cares is the EcoWorld Income Safe PA Plan, which is a personal accident plan designed specifically for EcoWorld buyers to safeguard themselves and loved ones in times of need. Policy holders will be compensated in the event of injuries, disability or death caused by violent, accidental, external and visible events.

“In our effort to answer the needs of our customers, especially in these challenging times, we designed this product to additionally compensate for a potential loss of income due to accidents or a Covid related event. With the addition of EcoWorld Income Safe PA Plan, we have now accomplished our mission in curating a step-by-step coverage throughout our customer’s journey in owning an EcoWorld product,” Chang said.

Tune Protect contributes RM24,000 from online product sales to Sustain Madhya’s Gift Fund

- Tune Protect fulfills its Sustainability commitment, channels contribution towards Madhya’s Gift, Yayasan Chow Kit’s critical healthcare fund for children from online product sales

Representing Tune Protect at the mock cheque presentation ceremony were Rohit Nambiar (“Rohit”), Chief Executive Officer and Yap Hsu Yi, Chief – People & Culture of Tune Protect. Yayasan Chow Kit was represented by Y.A.M Tunku Dato’ Sri Major Zain Al-‘Abidin Ibni Tuanku Muhriz, a member of the Board of Trustees and Y. Bhg. Dato’ Dr. Hartini Zainudin (“Dato’ Tini”), Co-Founder of Yayasan Chow Kit.

“We made several Sustainability commitments in 2021 and one of it includes embedding charity element into our product offerings. Seeing the shift in consumer buying preferences towards the online channels, we started off with our online Health and Lifestyle products last year and pledged our commitment to channel our CSR fund to Madhya’s Gift of Yayasan Chow Kit for every policy sold. This year, we have decided to extend the charity element beyond these two products and include all our online products, except for Travel and PA,” said Rohit.

Tune Protect began collaborating with YCK in 2017 and 2018 on the “Sponsor A Kid Back to School” initiative that saw the sponsorship of school uniforms and major roof leaks repairs. In 2019, Tune Protect sponsored PROBRATS rugby training for YCK kids conducted by COBRA Rugby Club and in 2020, Tune Protect reached out to assist with emergency funds for an accident victim and fire victims. From then on, Tune Protect have consistently journeyed with YCK year on year through various initiatives and with this recent initiative, Tune Protect has taken a step further by incorporating charity elements into its online products to be channeled to Madhya’s Gift Fund.

Y.A.M. Tunku’s Dato’ Sri Major Zain Al-‘Abidin said, “Tune Protect has been supporting YCK for a long time since 2017 and we’re very thankful for their continued support with this significant contribution towards Madhya’s Gift. This fund is particularly important to those in need at this tough economic juncture.”

Dato’ Tini continued, “Madhya’s Gift is Yayasan Chow Kit’s solution to ensure that sick children in Malaysia receive the support and funds needed to access quality and equitable medical services while cutting down the wait. Tune Protect is our first corporate partner to offer unwavering support and financial contribution to ensure we succeed. So far, we have helped 37 very sick children with access to medical services and critical medical help.”

The Group’s Malaysian subsidiary, Tune Protect Malaysia has more than 10 Lifestyle and Health products that are offered on its website and mobile app. Customers who purchase any of these products (except for Travel and PA), will indirectly help to make a difference in the lives of children who need medical and health services. The contribution will be drawn from Tune Protect’s CSR fund, based on the number of policies sold, not from the insurance premiums that customers pay.

Tune Protect has also been partnering with the Lions Club of Petaling Jaya for several years through various initiatives. The most recent collaborations include the sponsorship of food pyramid and COVID-19 prevention essentials to the visually impaired under the care of Malaysian Association for the Blind, food packs to Hospital Shah Alam front liners, sponsorship of a cataract machine to Kuala Lumpur General Hospital and a contribution of RM10,500 to YCK for Madhya’s Gift. The representatives from Lions Club of Petaling Jaya were also present to handover their contribution of RM10,500 to Madhya’s Gift.

Tune Protect Enters Partnership With Tm And Huawei Malaysia To Be First To Host Insurance Core System On Public Cloud In Malaysia

KUALA LUMPUR, 18 MARCH 2022: Tune Protect Malaysia (Tune Protect) is now the first insurer in Malaysia to have received the official approval from Bank Negara Malaysia (BNM) to host its insurance core system on Telekom Malaysia Bhd’s (TM) Cloud α Edge. This was made possible via a collaboration between Tune Protect, TM and Huawei Technologies (Malaysia) Sdn Bhd (Huawei Malaysia).This partnership will enable Tune Protect to re-platform its existing GIS (General Insurance System), an insurance core system, on to Cloud.

The hosting of the system will be done on Cloud α Edge — the only Malaysian-owned Hyperscaler Public Cloud that promotes data sovereignty. This marks a significant milestone as Cloud α Edge meets the standards of BNM’s Risk Management in Technology (RMiT) full guidance requirements checklist, making it the first and only Public Cloud so far to host an insurance core system in Malaysia.

The core system comes with a set of Systems Applications and Products (SAP) that will be completely hosted on Cloud α Edge which also ensure Tune Protect’s business is constantly at the forefront of digital transformation initiatives.

This collaboration between the three parties will ensure Tune Protect customers receive consistent speeds in user portal experience; more tailored and matching insurance offerings for their requirements; and better insurance premium rates due to infrastructure and intelligence optimisation.

Works are currently underway for the core insurance system to be deployed in multiple phases commencing July 2022. Prasanta Roy, Group Chief Technology Officer of Tune Protect said, “As the first insurer to have received the approval to host the core system on Cloud, we are further enhancing our group credentials. Cloud is the centrepiece of our digital transformation that will enable us to achieve speed-to-market and introduce more innovative products and services for our customers.”

Cloud α Edge plays an important role as a digital platform enabler through the offerings of a comprehensive set of cloud services in Malaysia and will transform Tune Protect’s existing business capabilities and services into a highly scalable, and agile cloud native open-source platform to unlock its existing capabilities into unlimited digital value. This transformation is crucial to support today’s fast-paced and demanding business operations and in ensuring the company consistently stays competitive in the market.

Tune Protect customers will experience a whole new level of engagement experience via this partnership. Aside from providing cloud and digital services, Huawei and TM are also rendering advisory and consultation services in terms of compliance and technical requirements that align to the guidance provided by Bank Negara Malaysia (BNM).

Meanwhile, Imri Mokhtar, Group Chief Executive Officer of TM said, “We fully understand the importance for FSI customers, including insurers such as Tune Protect, to have highly secured digital infrastructure while they continue accelerating their digital adoption. Given the rising volume of digital transactions and our commitment to excellent customer experience, we must ensure that the infrastructure supporting our partner is resilient, scalable and protected on all fronts. With TM Cloud α Edge being fully compliant to BNM’s RMiT, FSI players can reap the benefit of scalability and agility to future-proof their business, while simultaneously protecting customer data, at a superior price advantage. Through our enterprise and public sector business solutions arm, TM ONE, we are ready to serve the industry with end-to-end robust and secured digital infrastructure, befitting our role as the sole Malaysian Cloud Service Provider (CSP) under the MyDIGITAL initiative.”

Huawei Malaysia’s Vice President of the Cloud and AI Business Group, Mr Lim Chee Siong said, “It is always our goal at Huawei Cloud to dive into digitalisation and to provide everything as a service. Huawei will continue to innovate and team up with our partners to dive into digital and build the cloud foundation for an intelligent world. Cloud is just the beginning. We view it as a runway to transport businesses to even greater heights.”

TM is the only local player with its own core Data Centre and Cloud infrastructure with full data residency, locality and sovereignty. Through the collaboration with Huawei Malaysia, this infrastructure is reinforced through Cloud, AI and the most advanced cyber security practices and technologies, putting it right on track to become the only Malaysian-owned end-to-end Cloud and AI infrastructure service provider. This means the data in the Cloud is stored right here in Malaysia instead of abroad, providing a solution to the challenge of data sovereignty.

Read More

The hosting of the system will be done on Cloud α Edge — the only Malaysian-owned Hyperscaler Public Cloud that promotes data sovereignty. This marks a significant milestone as Cloud α Edge meets the standards of BNM’s Risk Management in Technology (RMiT) full guidance requirements checklist, making it the first and only Public Cloud so far to host an insurance core system in Malaysia.

The core system comes with a set of Systems Applications and Products (SAP) that will be completely hosted on Cloud α Edge which also ensure Tune Protect’s business is constantly at the forefront of digital transformation initiatives.

This collaboration between the three parties will ensure Tune Protect customers receive consistent speeds in user portal experience; more tailored and matching insurance offerings for their requirements; and better insurance premium rates due to infrastructure and intelligence optimisation.

Works are currently underway for the core insurance system to be deployed in multiple phases commencing July 2022. Prasanta Roy, Group Chief Technology Officer of Tune Protect said, “As the first insurer to have received the approval to host the core system on Cloud, we are further enhancing our group credentials. Cloud is the centrepiece of our digital transformation that will enable us to achieve speed-to-market and introduce more innovative products and services for our customers.”

Cloud α Edge plays an important role as a digital platform enabler through the offerings of a comprehensive set of cloud services in Malaysia and will transform Tune Protect’s existing business capabilities and services into a highly scalable, and agile cloud native open-source platform to unlock its existing capabilities into unlimited digital value. This transformation is crucial to support today’s fast-paced and demanding business operations and in ensuring the company consistently stays competitive in the market.

Tune Protect customers will experience a whole new level of engagement experience via this partnership. Aside from providing cloud and digital services, Huawei and TM are also rendering advisory and consultation services in terms of compliance and technical requirements that align to the guidance provided by Bank Negara Malaysia (BNM).

Meanwhile, Imri Mokhtar, Group Chief Executive Officer of TM said, “We fully understand the importance for FSI customers, including insurers such as Tune Protect, to have highly secured digital infrastructure while they continue accelerating their digital adoption. Given the rising volume of digital transactions and our commitment to excellent customer experience, we must ensure that the infrastructure supporting our partner is resilient, scalable and protected on all fronts. With TM Cloud α Edge being fully compliant to BNM’s RMiT, FSI players can reap the benefit of scalability and agility to future-proof their business, while simultaneously protecting customer data, at a superior price advantage. Through our enterprise and public sector business solutions arm, TM ONE, we are ready to serve the industry with end-to-end robust and secured digital infrastructure, befitting our role as the sole Malaysian Cloud Service Provider (CSP) under the MyDIGITAL initiative.”

Huawei Malaysia’s Vice President of the Cloud and AI Business Group, Mr Lim Chee Siong said, “It is always our goal at Huawei Cloud to dive into digitalisation and to provide everything as a service. Huawei will continue to innovate and team up with our partners to dive into digital and build the cloud foundation for an intelligent world. Cloud is just the beginning. We view it as a runway to transport businesses to even greater heights.”

TM is the only local player with its own core Data Centre and Cloud infrastructure with full data residency, locality and sovereignty. Through the collaboration with Huawei Malaysia, this infrastructure is reinforced through Cloud, AI and the most advanced cyber security practices and technologies, putting it right on track to become the only Malaysian-owned end-to-end Cloud and AI infrastructure service provider. This means the data in the Cloud is stored right here in Malaysia instead of abroad, providing a solution to the challenge of data sovereignty.

Tune Protect posted commendable double digit 4Q21 / FY21 NWP growth, despite earnings drag on TPT’s one-off loss

Highlights:

However, its 4Q21 performance was affected mainly by the share of losses by the Group’s associate company, Tune Protect Thailand (“TPT”), as well as fair value losses and flood related claims. The Group posted Loss After Tax (“LAT”) of RM14.7 million and RM18.2 million for 4Q21 and FY21 respectively.

Excess of loss cover limited flood claims “The share of losses in TPT’s books was primarily due to a Group Personal Accident (“PA”) account which will no longer be renewed. The excess of loss cover also limited our flood claims.”

“Despite the gross exposure of RM7.0 million, net impact to Profit Before Tax (“PBT”) was only RM3.6 million attributable to losses capped at RM1 million due to excess of loss cover and reinstatement of premium of RM2.6 million,” explained Rohit.

Strong topline growth in Thailand Going forward, Rohit believes that TPT will recover as evidenced by its encouraging topline growth in FY21. TPT’s full year NWP doubled, contributed mainly by the Lifestyle segment which increased 60.8% YoY and the Health segment which increased 22x.

TPT is poised to capitalise on the recovery of domestic and international travel in 2022. It has introduced Covid-19 related covers such as Tune iPass for inbound travel and launched a brand new e-commerce website to host a list of Lifestyle and Health products.

Rising equities and ESG investments In response to an evolving economic landscape which saw a persistent rise in global bond yields in 4Q21, Tune Protect repositioned its investment portfolio valued at RM758.0 million as at 31 December 2021.

In December 2021, Tune Protect achieved its target Environmental, Social and Governance (“ESG”) foreign equity allocation of up to 10%. The Group’s total ESG funds mix as at December 2021 is 13.4%.

“We have repositioned for a more defensive portfolio mix by re-allocating 15% of our longer duration corporate bonds to short duration government bonds. Average bond duration was circa 2.8 years at the end of 2021. Our portfolio now is less sensitive to yield curve volatility,” Rohit said.

Tapping more than 150 million customers Rohit remains positive of the Group’s future. The Group is on track to becoming a mobile-first company with new products developed with mobile purchase option and have also succeeded in being inducted into the FTSE4Good Bursa Malaysia Index. It is also on track to achieve its targets of retention of up to 70% in all its Lines of Business (“LOB”), becoming a more efficient organisation on a ratio basis and the preferred employer among insurers for millennial talents.

“The company is placing greater emphasis on e-commerce. We are widening our distribution network with access to more than 150 million customers. We have also achieved 46% increase in registered users for our mobile application. The Group had also surpassed expectations in FY21 by registering a positive customer Net Promoter Score (“NPS”),” Rohit highlighted.

To fast track its growth objectives, Tune Protect is planning to evolve its technology arm as a profit centre and grow its presence in the ASEAN market, becoming a one-stop centre for reinsurance, technical expertise, and underwriting services through its reinsurance entity Tune Protect Re.

Exiting low retention commercial segments Rohit is positive that the Group will achieve its targets and objectives by 2023, mainly due to higher retention expected in FY22 with further withdrawal from the commercial segment.

“We are exiting and scaling down low retention commercial segments such as the commercial hull and aviation businesses. This enables us to renegotiate better treaty terms with reinsurers. On the bright side, there was growth in travel with YoY increase for every quarter of 2021, mainly contributed by the Middle East market which registered an impressive growth of 167%. With travel reopening and AirAsia making a comeback, we are optimistically cautious that travel business will rebound.”

“FY21 premiums of RM101.0 million were up 55.2% YoY. Recovery was observed in our Malaysian general insurance in 2H21, in tandem with the easing of lockdown and gradual recovery of economic activities.” Rohit explained.

The positive market outlook for FY22 is reflected in domestic and international economic projections. According to Bank Negara Malaysia (BNM), the Malaysian economy will expand between 5.5% and 6.5% in 2022. While according to Bank of Thailand, Thailand’s 2022 GDP growth is expected to be around 3.4%. These will be driven by the easing of restrictions and improved global / domestic demand and consumption.

Read More

- 4Q21/FY21 NWP up 17.2% /19.5% YoY; 4Q21 earnings dampened mainly by TPT’s share of losses, as well as fair value losses and flood claims

- Repositioned investment portfolio due to rising global bond yields, exiting low retention commercial segments

- Focused on growth objectives via e-commerce and ASEAN expansion

However, its 4Q21 performance was affected mainly by the share of losses by the Group’s associate company, Tune Protect Thailand (“TPT”), as well as fair value losses and flood related claims. The Group posted Loss After Tax (“LAT”) of RM14.7 million and RM18.2 million for 4Q21 and FY21 respectively.

Excess of loss cover limited flood claims “The share of losses in TPT’s books was primarily due to a Group Personal Accident (“PA”) account which will no longer be renewed. The excess of loss cover also limited our flood claims.”

“Despite the gross exposure of RM7.0 million, net impact to Profit Before Tax (“PBT”) was only RM3.6 million attributable to losses capped at RM1 million due to excess of loss cover and reinstatement of premium of RM2.6 million,” explained Rohit.

Strong topline growth in Thailand Going forward, Rohit believes that TPT will recover as evidenced by its encouraging topline growth in FY21. TPT’s full year NWP doubled, contributed mainly by the Lifestyle segment which increased 60.8% YoY and the Health segment which increased 22x.

TPT is poised to capitalise on the recovery of domestic and international travel in 2022. It has introduced Covid-19 related covers such as Tune iPass for inbound travel and launched a brand new e-commerce website to host a list of Lifestyle and Health products.

Rising equities and ESG investments In response to an evolving economic landscape which saw a persistent rise in global bond yields in 4Q21, Tune Protect repositioned its investment portfolio valued at RM758.0 million as at 31 December 2021.

In December 2021, Tune Protect achieved its target Environmental, Social and Governance (“ESG”) foreign equity allocation of up to 10%. The Group’s total ESG funds mix as at December 2021 is 13.4%.

“We have repositioned for a more defensive portfolio mix by re-allocating 15% of our longer duration corporate bonds to short duration government bonds. Average bond duration was circa 2.8 years at the end of 2021. Our portfolio now is less sensitive to yield curve volatility,” Rohit said.

Tapping more than 150 million customers Rohit remains positive of the Group’s future. The Group is on track to becoming a mobile-first company with new products developed with mobile purchase option and have also succeeded in being inducted into the FTSE4Good Bursa Malaysia Index. It is also on track to achieve its targets of retention of up to 70% in all its Lines of Business (“LOB”), becoming a more efficient organisation on a ratio basis and the preferred employer among insurers for millennial talents.

“The company is placing greater emphasis on e-commerce. We are widening our distribution network with access to more than 150 million customers. We have also achieved 46% increase in registered users for our mobile application. The Group had also surpassed expectations in FY21 by registering a positive customer Net Promoter Score (“NPS”),” Rohit highlighted.

To fast track its growth objectives, Tune Protect is planning to evolve its technology arm as a profit centre and grow its presence in the ASEAN market, becoming a one-stop centre for reinsurance, technical expertise, and underwriting services through its reinsurance entity Tune Protect Re.

Exiting low retention commercial segments Rohit is positive that the Group will achieve its targets and objectives by 2023, mainly due to higher retention expected in FY22 with further withdrawal from the commercial segment.

“We are exiting and scaling down low retention commercial segments such as the commercial hull and aviation businesses. This enables us to renegotiate better treaty terms with reinsurers. On the bright side, there was growth in travel with YoY increase for every quarter of 2021, mainly contributed by the Middle East market which registered an impressive growth of 167%. With travel reopening and AirAsia making a comeback, we are optimistically cautious that travel business will rebound.”

“FY21 premiums of RM101.0 million were up 55.2% YoY. Recovery was observed in our Malaysian general insurance in 2H21, in tandem with the easing of lockdown and gradual recovery of economic activities.” Rohit explained.

The positive market outlook for FY22 is reflected in domestic and international economic projections. According to Bank Negara Malaysia (BNM), the Malaysian economy will expand between 5.5% and 6.5% in 2022. While according to Bank of Thailand, Thailand’s 2022 GDP growth is expected to be around 3.4%. These will be driven by the easing of restrictions and improved global / domestic demand and consumption.

Tune Protect Malaysia Expedites Claim Pay-outs Within 3 Days to Victims Affected by Floods

KUALA LUMPUR, 22 December 2021 – Tune Insurance Malaysia Berhad (“Tune Protect Malaysia”, “Tune Protect”) has been doing its part by expediting claims settlements within 3 days for customers affected by the floods recently.

“The floods have been extremely devastating and here at Tune Protect, we always prioritise our customers and would want to do our bit to help them to rebuild their lives. Due to the urgency of the situation that the victims are currently facing, the flood claim payment will be distributed within 3 days instead of the usual 10 working days frame,” said Rohit Nambiar (“Rohit”), Group Chief Executive Officer of Tune Protect.

“We understand that no amount of help can fully replace the loss and trauma suffered by the flood victims but we hope that the speedy pay-out processing would help to ease the burden,” he added.

Affected customers can reach out to Tune Protect Malaysia 24/7 dedicated claims hotlines and email while also referring to Tune Protect social media channels for guidance on claims. Tune Protect is also reaching out to customers via SMS and emails to advise them of the claim process.

Besides, policyholders who are affected by the floods would not need to make a police report and present any documents for both claims involving their motor vehicles and residential and commercial properties respectively.

Once the motor vehicles are brought to any of the 300 Tune Protect panel workshops nationwide, these workshops will verify the damages and handle the claim process. For damaged properties, an onsite assessment will be conducted by a loss adjuster with an onsite approval of up to RM20K. As a result of these initiatives, Tune Protect has been receiving claim applications and is currently working towards fast tracking the pay-outs.

Natural calamities such as the flood that Malaysia is currently battling may recur in the future. Customers are encouraged to add on special perils coverage into their motor insurance to ensure that their vehicles are covered comprehensively against the unforeseen natural calamities such as flood, landslide, typhoon, hurricane, and other convulsions of nature. To find out more about Tune Protect motor insurance, and how to add on the coverage for special perils, customers can go online at www.tuneprotect.com, reach out to its Agents nationwide, or visit the digital platform of Tune Protect’s partner, Qoala.

For any flood claims and inquiry, customers can contact 1800 228 863 for Motor Claims and 03 7989 0310 for Property Claims which are available 24-hours and 7 days a week. Emails can also be sent to [email protected].

Read More

“The floods have been extremely devastating and here at Tune Protect, we always prioritise our customers and would want to do our bit to help them to rebuild their lives. Due to the urgency of the situation that the victims are currently facing, the flood claim payment will be distributed within 3 days instead of the usual 10 working days frame,” said Rohit Nambiar (“Rohit”), Group Chief Executive Officer of Tune Protect.

“We understand that no amount of help can fully replace the loss and trauma suffered by the flood victims but we hope that the speedy pay-out processing would help to ease the burden,” he added.

Affected customers can reach out to Tune Protect Malaysia 24/7 dedicated claims hotlines and email while also referring to Tune Protect social media channels for guidance on claims. Tune Protect is also reaching out to customers via SMS and emails to advise them of the claim process.

Besides, policyholders who are affected by the floods would not need to make a police report and present any documents for both claims involving their motor vehicles and residential and commercial properties respectively.

Once the motor vehicles are brought to any of the 300 Tune Protect panel workshops nationwide, these workshops will verify the damages and handle the claim process. For damaged properties, an onsite assessment will be conducted by a loss adjuster with an onsite approval of up to RM20K. As a result of these initiatives, Tune Protect has been receiving claim applications and is currently working towards fast tracking the pay-outs.

Natural calamities such as the flood that Malaysia is currently battling may recur in the future. Customers are encouraged to add on special perils coverage into their motor insurance to ensure that their vehicles are covered comprehensively against the unforeseen natural calamities such as flood, landslide, typhoon, hurricane, and other convulsions of nature. To find out more about Tune Protect motor insurance, and how to add on the coverage for special perils, customers can go online at www.tuneprotect.com, reach out to its Agents nationwide, or visit the digital platform of Tune Protect’s partner, Qoala.

For any flood claims and inquiry, customers can contact 1800 228 863 for Motor Claims and 03 7989 0310 for Property Claims which are available 24-hours and 7 days a week. Emails can also be sent to [email protected].

Tune Protect Introduces New Covid-19 Travel Protection Plan For Healthcare Travellers To Malaysia

KUALA LUMPUR, 22 NOVEMBER 2021 – Tune Protect Group Berhad (“Tune Protect”, “Group”) and the Malaysia Healthcare Travel Council (“MHTC”) have collaborated to introduce a Covid-19 travel protection plan for healthcare travellers seeking medical advice and treatments in Malaysian private hospitals. Known as the Covid Travel Pass+, it comes in two different plans, the Basic and Premium plans which provide medical expenses and hospitalisation coverage due to Covid-19 of up to RM100,000 (USD23,926.31) and RM350,000 (USD83,742.07) respectively. Both plans also come with a bereavement allowance of RM10,000 (USD2,392.63).

Aside to the Covid-19 coverage, the Covid Travel Pass+ benefits include trip cancellation, flight on arrival delay, loss or damage to checked-in baggage, and Covid-19 diagnosis quarantine allowance (RM350 or USD83.83 per day up to RM2,450 or USD585.98) among others.

“Malaysia is recognised for its award-winning healthcare services and with travelling restrictions loosening up, we are expecting the number of healthcare travellers to increase. With this, we are pleased to collaborate with MHTC as we believe in going where customers want us to be. The timely collaboration provides convenience and worry-free travel experience for healthcare travellers seeking to access medical treatment and advice here in Malaysia,” said Rohit Nambiar (“Rohit”), Group Chief Executive Officer of Tune Protect.

Malaysia has been a preferred destination for healthcare travellers around the world, amassing a total of 1,220,000 healthcare travellers in 2019. Known for delivering world-class quality healthcare services which are both easily accessible and competitively affordable, Malaysia is fortifying its healthcare offerings through building strategic partnerships to offer the Best Malaysia Healthcare Travel Experience.

“Malaysia Healthcare is committed in partnering with entities who share the same dedication as us in offering a safe and seamless travel experience. We are pleased to collaborate with Tune Protect in assuring healthcare travellers that they are protected and have better peace of mind during their travels with the Covid Travel Pass+. This is part of our strategy to demonstrate Malaysia’s strengths as a safe and trusted destination, and offer healthcare travellers accessible and affordable protection plans as the country begins to welcome international visitors back to our shores,” said En. Mohd Daud Mohd Arif, Chief Executive Officer of MHTC.

Healthcare travellers can visit Malaysia Healthcare and click on the Covid Travel Pass+ web banner to purchase the plan, or if they wish to find out more about the product. The web banner is also available on the websites of participating MHTC hospital members.

“As we aim to be the Lifestyle insurer that everyone loves, our strong foothold in the Travel segment in more than 60 countries, including being the market leader in Thailand, puts us in good stead to offer healthcare travellers the much-needed protection, especially Covid coverage as we enter the endemic phase,” Rohit concluded.

For more information about Tune Protect and MHTC, please visit www.tuneprotect.com and malaysiahealthcare.org.

Tune Protect registered double digit topline growth in 3Q21, Underwriting Profit recovered from losses

Highlights

“We expect the pace of recovery to increase in 2022 supported by ASEAN countries reopening their borders. The growth in Travel is expected to continue in 4Q21 and 2022 as mandatory travel insurance is gaining ground,” said Rohit Nambiar (“Rohit”) Tune Protect Group Chief Executive Officer.

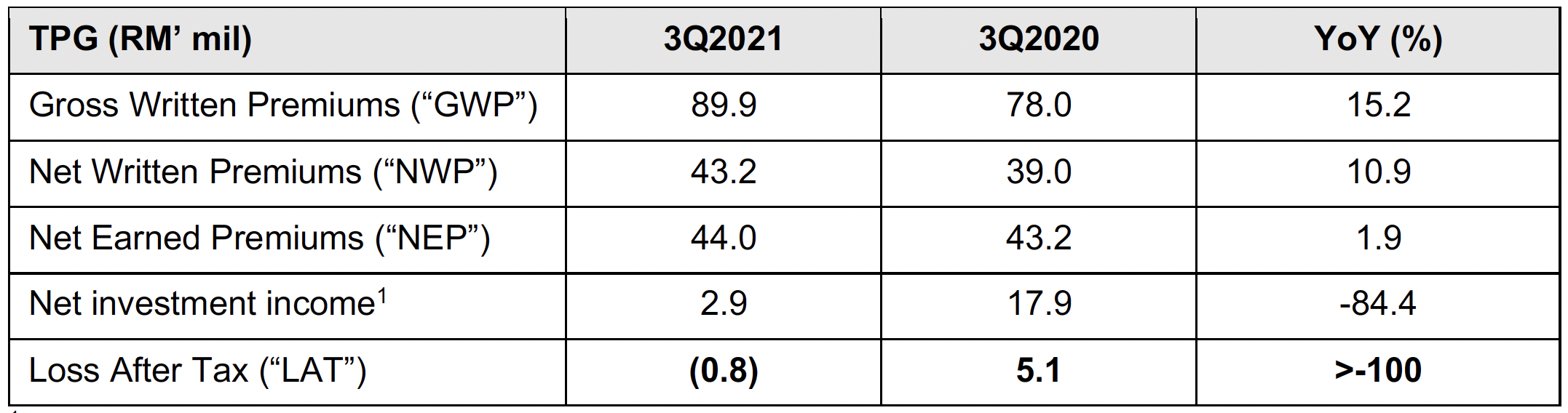

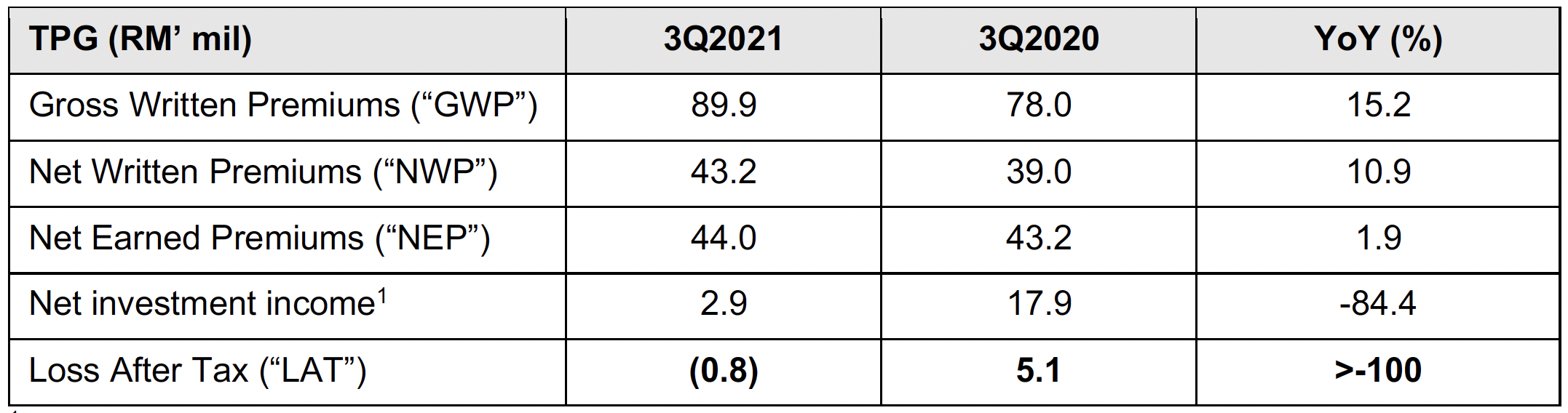

Rohit also attributes the improvement in the Group’s 3Q21 Underwriting Profit to favourable claims experience, which had also contributed to a 22.7% improvement to the Group’s Combined Ratio of 99.4%. Net Earned Premiums (“NEP”) also rose YoY by 1.9%, though the growth was lower as the Group’s Malaysian General Insurance subsidiary, Tune Protect Malaysia (“TPM”) had a higher cession of the Group’s commercial business.

The Group however registered a marginal Loss After Tax (“LAT”) of RM0.8 million in 3Q21, due to lower net investment income and share of losses of RM3.1 million from the Group’s Thai associate, Tune Protect Thailand (“TPT”) mainly from a group PA account exposure.

Rohit commented, “The gradual recovery of the Group’s fixed income market over the past 6 months declined at the end of 3Q21 as treasury yields increased on inflationary pressure, as well as expectation of the US Federal Reserve starting to reduce bond purchases by as early as 4Q21. Fixed income market volatility is expected to continue in the near to medium term. We are repositioning for a more defensive portfolio mix by re-allocating 15% of our longer duration corporate bonds to short duration government bonds.”

Group Performance

1 Aggregate of investment income, realised gains and losses, and fair value gains and losses

Group Performance by Key Business Pillars

2 Excluding management expenses

Health & Lifestyle in motion

Rohit remains bullish about the overall market outlook. Other than the Travel segment, he also expects the Health and Lifestyle pillars to boost the Group’s topline into next year with more products expected to be launched in 2022.

“Our Health and Lifestyle products launched this year have continued to gain traction as we are building economies of scale by increasing our partnership base and rolling out aggressive marketing,” said Rohit.

To date, the Group has launched several products in the Health segment such as PRO-Health Medical – a cashless health coverage targeting millennials; VSafe COVID which covers for the infection of the disease and the side effects of the vaccine; and myFlexi CI – a customisable critical illness plan. In addition to that, these products are complemented with value-added propositions offered by the Group’s strategic partners such as emotional wellbeing assessment for policyholders; teleconsultation as well as second medical opinion services. Most recent, the Group launched its vaccine insurance as an add-on to the existing inbound product for customers travelling to the UAE.

There were also innovative offerings from the Lifestyle segment this year, such as Home Easy & Home Shield, a residential building and home content protection with great flexibility for homeowners to tailor their plan with optional add-ons to meet their individual needs. It also offers up to 40% savings in premium with complimentary benefits if customers opt to cover both their homes and its contents. The Group had also launched pet travel and student assurance in the Middle East and inland transportation insurance in Indonesia and Thailand.

In partnerships, the Group recently tied up with Qoala, the digital insurance marketplace to distribute Motor Easy, a motor insurance product by TPM in addition to an earlier collaboration with Cover Genius to distribute a product that protects against damage or loss of goods during transit from the merchants to Shopee customers in Thailand.

In the Travel segment, the Covid Travel Pass has just been launched via the airasia Super App for inbound travellers to satisfy the mandatory insurance requirements by the respective Malaysia and Thai governments.

Sustainability at the core

The CEO reaffirms the Group’s strong commitment to a sustainable future in line with its Environment, Social and Governance (ESG) goals.

“To enhance the social safety net for the B40 income group, we will be launching a Perlindungan Tenang product, and a micro health protection plan soon,” Rohit elaborated.

The company is supportive of the government’s recent Budget 2022 which made it mandatory for all Public Listed Companies (PLCs) to appoint at least one woman to the Board of Directors.

“We are currently above the Malaysian Code on Corporate Governance (MCCG) recommendation of having at least 30% women representation,” Rohit concluded.

Read More

- 3Q21 GWP grew 15.2% YoY; Underwriting Profit recovered YoY from losses

- Growth in Travel expected to continue in 4Q21 and progressing into 2022

- Health and Lifestyle pillars to spur topline growth further

“We expect the pace of recovery to increase in 2022 supported by ASEAN countries reopening their borders. The growth in Travel is expected to continue in 4Q21 and 2022 as mandatory travel insurance is gaining ground,” said Rohit Nambiar (“Rohit”) Tune Protect Group Chief Executive Officer.

Rohit also attributes the improvement in the Group’s 3Q21 Underwriting Profit to favourable claims experience, which had also contributed to a 22.7% improvement to the Group’s Combined Ratio of 99.4%. Net Earned Premiums (“NEP”) also rose YoY by 1.9%, though the growth was lower as the Group’s Malaysian General Insurance subsidiary, Tune Protect Malaysia (“TPM”) had a higher cession of the Group’s commercial business.

The Group however registered a marginal Loss After Tax (“LAT”) of RM0.8 million in 3Q21, due to lower net investment income and share of losses of RM3.1 million from the Group’s Thai associate, Tune Protect Thailand (“TPT”) mainly from a group PA account exposure.

Rohit commented, “The gradual recovery of the Group’s fixed income market over the past 6 months declined at the end of 3Q21 as treasury yields increased on inflationary pressure, as well as expectation of the US Federal Reserve starting to reduce bond purchases by as early as 4Q21. Fixed income market volatility is expected to continue in the near to medium term. We are repositioning for a more defensive portfolio mix by re-allocating 15% of our longer duration corporate bonds to short duration government bonds.”

Group Performance

1 Aggregate of investment income, realised gains and losses, and fair value gains and losses

Group Performance by Key Business Pillars

2 Excluding management expenses

Health & Lifestyle in motion

Rohit remains bullish about the overall market outlook. Other than the Travel segment, he also expects the Health and Lifestyle pillars to boost the Group’s topline into next year with more products expected to be launched in 2022.

“Our Health and Lifestyle products launched this year have continued to gain traction as we are building economies of scale by increasing our partnership base and rolling out aggressive marketing,” said Rohit.

To date, the Group has launched several products in the Health segment such as PRO-Health Medical – a cashless health coverage targeting millennials; VSafe COVID which covers for the infection of the disease and the side effects of the vaccine; and myFlexi CI – a customisable critical illness plan. In addition to that, these products are complemented with value-added propositions offered by the Group’s strategic partners such as emotional wellbeing assessment for policyholders; teleconsultation as well as second medical opinion services. Most recent, the Group launched its vaccine insurance as an add-on to the existing inbound product for customers travelling to the UAE.

There were also innovative offerings from the Lifestyle segment this year, such as Home Easy & Home Shield, a residential building and home content protection with great flexibility for homeowners to tailor their plan with optional add-ons to meet their individual needs. It also offers up to 40% savings in premium with complimentary benefits if customers opt to cover both their homes and its contents. The Group had also launched pet travel and student assurance in the Middle East and inland transportation insurance in Indonesia and Thailand.

In partnerships, the Group recently tied up with Qoala, the digital insurance marketplace to distribute Motor Easy, a motor insurance product by TPM in addition to an earlier collaboration with Cover Genius to distribute a product that protects against damage or loss of goods during transit from the merchants to Shopee customers in Thailand.

In the Travel segment, the Covid Travel Pass has just been launched via the airasia Super App for inbound travellers to satisfy the mandatory insurance requirements by the respective Malaysia and Thai governments.

Sustainability at the core

The CEO reaffirms the Group’s strong commitment to a sustainable future in line with its Environment, Social and Governance (ESG) goals.

“To enhance the social safety net for the B40 income group, we will be launching a Perlindungan Tenang product, and a micro health protection plan soon,” Rohit elaborated.

The company is supportive of the government’s recent Budget 2022 which made it mandatory for all Public Listed Companies (PLCs) to appoint at least one woman to the Board of Directors.

“We are currently above the Malaysian Code on Corporate Governance (MCCG) recommendation of having at least 30% women representation,” Rohit concluded.

Tune Protect and AirAsia First to Launch Travel Protection to Meet Mandatory Coverage for Foreign Travellers into Langkawi and Thailand

Tune Protect and AirAsia provide convenient, one-stop digital-first solution to prepare for year-end travel boom with required travel protection for Covid-19 coverage

KUALA LUMPUR, 17 NOVEMBER 2021 – In an industry first, Tune Protect and AirAsia today launched the Covid Travel Pass as an added convenience for air travellers to meet the mandatory insurance coverage set by the governments for fully vaccinated international travellers flying into the countries. Kicking off with Langkawi, Malaysia and various tourist destinations in Thailand, the service will be expanded to include other countries and destinations in due course.

Currently, travellers flying AirAsia into Langkawi, Malaysia and destinations in Thailand can subscribe to the Covid Travel Pass when booking their flight tickets on the AirAsia superapp, post flight purchase subscription options are also available before travellers depart.

The introduction of the Covid Travel Pass plans is timely as they also meet the year-end travel needs of AirAsia’s guests who wish to head to their much-awaited holidays and the impending opening of regional and international borders.

The Covid Travel Pass plans are complete with enhanced COVID-19 coverage to satisfy the Malaysian government’s requirement for international travellers coming into Langkawi to have mandatory insurance coverage of USD80,000 while for Thailand, the required mandatory coverage is USD50,000.

“As Malaysia and Thailand open their international borders, AirAsia is prepared to meet the rise in the pent-up travel demand especially towards the end of year as a peak travel period. Travelling today comes with a new set of protocols and we want to reassure our guests that we are ready to welcome them with the right travel protection products provided by Tune Protect while observing strict and disciplined protocols to ensure the safety of our passengers in flight and beyond so that they can have a total peace of mind,” said Bo Lingam, Group CEO of AirAsia Aviation Limited.

AirAsia has spent the period of downtime in travel over the past one-and-a-half years to further improve and revamp its flight procedures and processes. In the highest interest of safety and wellbeing of all its guests and employees, AirAsia will accept only fully vaccinated guests on board its flights, and likewise ensure only fully-vaccinated employees will operate flights and be on-duty at airport terminals.

Despite mostly not flying for a good part of the past 18 months, all AirAsia’s aircraft are properly maintained according to procedures set by the manufacturer. AirAsia has set up an in-house maintenance, repair, and operations (MRO) unit called Asia Digital Engineering that provides services not only to AirAsia but also other airlines. Likewise, all its pilots and cabin crew are regularly sent for mandatory refresher courses and ongoing retraining so that they are always on top of their job.

“We are excited for our customers and AirAsia guests as they take their much-needed vacation time. The Covid Travel Pass satisfies the requirements in both countries to ensure customers are better prepared and protected during their holidays and have a worry-free vacation. Guests can purchase the Covid Travel Pass when booking their AirAsia flights on the flight booking platform of the airasia Super App, making it super convenient and hassle-free,” said Rohit Nambiar, Group Chief Executive Officer of Tune Protect.

For AirAsia’s international guests flying into Langkawi, Malaysia, the Covid Travel Pass provides a coverage of up to RM350,000 in medical expenses and hospitalization due to accident and sickness including a COVID-19 infection, as well as a quarantine allowance of RM150 per day. Premiums start from as low as RM170 per guest per trip.

For travellers flying with AirAsia into Thailand, the Covid Travel Pass provides medical expenses due to accidents and sickness due to COVID-19 of up to THB1.8 million.

The Covid Travel Pass is available via the airasia Super App and will soon be made available to other customers via the Tune Protect’s website. Travellers who have purchased AirAsia flights prior to 1 November 2021 will be notified via push notifications to add on the required insurance coverage with the relevant post flight purchase options.

Other existing benefits from the Covid Travel Pass include personal accident, travel inconvenience such as trip curtailment, flight delay, loss, or damage to checked baggage, baggage delay on arrival; ground inconvenience benefit due to snatch theft, emergency medical evacuation and 24-hours travel assistance services.

Earlier in February, Tune Protect had also enhanced the Tune Protect AirAsia Travel Protection for travellers from Malaysia entering Singapore which included RM100,000 medical and hospitalisation expenses coverage due to COVID-19, meeting the mandatory insurance requirement of the Singapore government for coverage of SGD30,000.

For more information about Tune Protect Covid Travel Pass, please visit the official website at www.tuneprotect.com/airasia